In today's fast-paced world, managing your finances efficiently is crucial, and checks play a vital role in this process. If you're a Chase Bank customer, you might find yourself needing to order checks for various reasons, such as making payments, managing expenses, or simply having them on hand for emergencies. This comprehensive guide will walk you through the steps of ordering checks from Chase Bank, ensuring a seamless experience while highlighting the benefits of doing so.

Chase Bank, one of the largest and most reputable financial institutions in the United States, offers a variety of banking services tailored to meet the needs of its diverse clientele. Ordering checks from Chase Bank is a straightforward process, thanks to their user-friendly online platform and dedicated customer support. Whether you're a new account holder or a long-time customer, this guide will provide you with the necessary insights and tips to make the ordering process as smooth as possible.

In addition to outlining the steps to order checks from Chase Bank, this article will delve into the benefits of using checks in today's digital age, the security measures in place to protect your financial information, and tips for effectively managing your checkbook. By the end of this guide, you will have a thorough understanding of the entire process, empowering you to make informed decisions about your banking needs.

Read also:Movierulz 7 2024 Download Your Guide To Safe And Secure Streaming

Table of Contents

- Understanding Checks and Their Importance

- Chase Bank: An Overview

- How to Order Checks from Chase Bank?

- The Online Ordering Process

- Ordering Checks via Phone: A Step-by-Step Guide

- Can You Order Checks in Person at Chase Bank?

- Understanding the Costs and Fees Involved

- Security Features of Chase Checks

- Customizing Your Chase Checks

- Tips for Managing Your Checkbook Effectively

- Avoiding Common Mistakes When Ordering Checks

- The Environmental Impact of Paper Checks

- Are There Alternatives to Using Checks?

- FAQs About Ordering Checks from Chase Bank

- Conclusion

Understanding Checks and Their Importance

Checks have been a fundamental part of the financial landscape for centuries, serving as a reliable and secure method of payment. They offer a tangible way to track transactions, providing both the payer and the payee with a clear record of the exchange. Despite the rise of digital payment methods, checks remain relevant for many individuals and businesses due to their unique advantages.

Checks offer a level of control over finances that electronic payments may not provide. They allow payers to dictate exactly when a payment is made, which can be particularly useful for budgeting purposes. Additionally, checks often come with built-in security features, such as watermarking and microprinting, which help prevent fraud.

For businesses, checks are invaluable for payroll purposes, paying vendors, and managing cash flow. They facilitate large transactions that might otherwise require complex digital arrangements. Furthermore, checks can be a preferred method for those who value privacy, as they do not require the sharing of sensitive banking information.

Chase Bank: An Overview

Chase Bank, officially known as JPMorgan Chase Bank, N.A., is a leading global financial services firm with operations in over 100 countries. With a rich history dating back to 1799, Chase Bank has established itself as a trusted provider of comprehensive financial solutions, including personal banking, credit cards, mortgages, auto financing, investment advice, and more.

As one of the largest banks in the United States, Chase serves millions of customers through its extensive branch network and advanced online banking platform. The bank is committed to providing top-notch customer service and innovative products designed to meet the evolving needs of its clients.

Chase Bank's reputation for reliability and security makes it a preferred choice for individuals and businesses alike. With a strong emphasis on digital transformation, Chase continues to enhance its services, making it easier than ever to manage your finances, including the process of ordering checks.

Read also:Ultimate Guide To Www 5movierulz 2024 Download Everything You Need To Know

How to Order Checks from Chase Bank?

Ordering checks from Chase Bank is a simple process that can be completed through several convenient methods. Whether you prefer the ease of online ordering, the personal touch of a phone call, or the traditional approach of visiting a branch, Chase Bank accommodates your needs. Let's explore each method in detail to help you decide which option is best for you.

The Online Ordering Process

Ordering checks online with Chase Bank is the most efficient and convenient option for most account holders. Here's how to do it:

- Log in to your Chase online banking account using your credentials.

- Navigate to the "Checks" or "Order Checks" section within your account dashboard.

- Select the account for which you wish to order checks.

- Choose your preferred check design and quantity.

- Review your order details, including the cost and shipping information.

- Submit your order and wait for a confirmation email with tracking details.

By following these steps, you'll have your new checks delivered to your doorstep in no time. Chase Bank's online platform ensures a secure and user-friendly experience, allowing you to manage your check orders with ease.

Ordering Checks via Phone: A Step-by-Step Guide

If you prefer to order checks by phone, Chase Bank offers a dedicated customer service line to assist you. Here's how you can order checks via phone:

- Call Chase Bank's customer service at the number listed on their official website.

- Provide your account information and verify your identity.

- Request to order checks and specify the account and check design you prefer.

- Confirm your order details, including the cost and expected delivery date.

- Receive a confirmation number and tracking information for your order.

Ordering checks by phone is a great option for those who prefer personalized assistance or have specific questions about their order. Chase Bank's customer service representatives are knowledgeable and ready to help you with your check ordering needs.

Can You Order Checks in Person at Chase Bank?

Yes, you can order checks in person at any Chase Bank branch. This option is ideal for customers who prefer face-to-face interactions or need additional assistance with their order. Here's how to do it:

- Visit your local Chase Bank branch during business hours.

- Speak to a bank representative and request to order checks.

- Provide your account information and select your desired check design.

- Review and confirm your order details, including any applicable fees.

- Receive a receipt with your order confirmation number and estimated delivery date.

Ordering checks in person allows you to address any questions or concerns directly with a bank representative, ensuring a smooth and hassle-free experience.

Understanding the Costs and Fees Involved

When ordering checks from Chase Bank, it's essential to be aware of the costs and fees associated with your order. The price of checks can vary based on factors such as the design, quantity, and any additional features you choose. Here are some common cost considerations:

- Standard check designs are typically more affordable than customized options.

- The cost per check may decrease when ordering in larger quantities.

- Additional features, such as duplicate checks or enhanced security, may incur extra fees.

- Shipping and handling fees may apply, depending on your preferred delivery method.

To ensure transparency, Chase Bank provides a detailed breakdown of the costs and fees during the ordering process. It's advisable to review these details carefully to avoid any surprises on your bank statement.

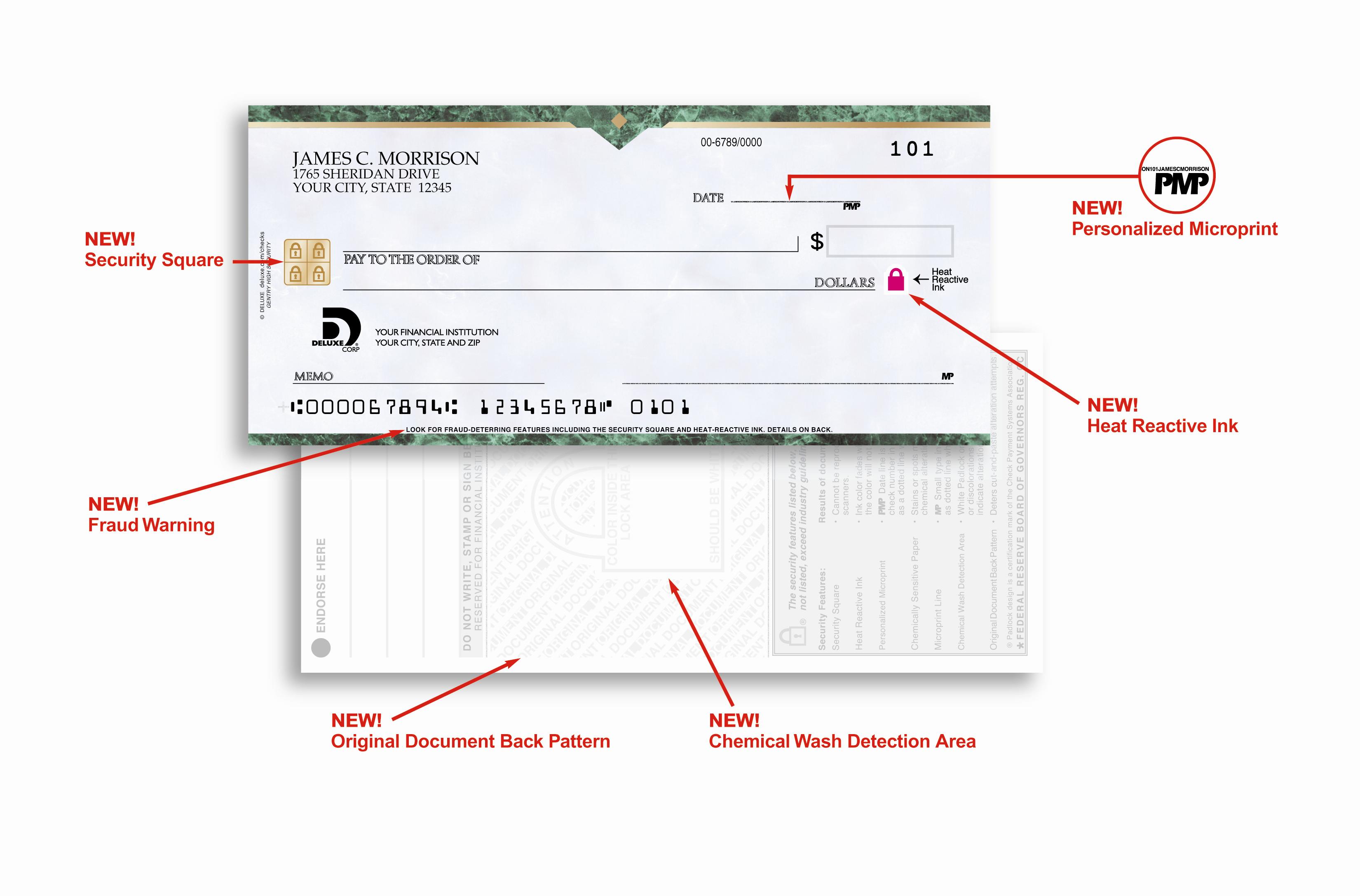

Security Features of Chase Checks

Chase Bank takes the security of your financial transactions seriously, which is why their checks come equipped with a range of security features to protect against fraud and unauthorized use. Here are some of the key security features you can expect:

- Watermarking: An embedded watermark visible when held up to the light, making it difficult to replicate.

- Microprinting: Tiny, precise text that appears blurred when photocopied, deterring counterfeiting.

- Security Thread: A thin strip embedded within the check paper, visible under ultraviolet light.

- Holograms: Reflective images that change appearance when viewed from different angles, providing an additional layer of protection.

These security features work together to safeguard your financial information and ensure the authenticity of your checks, giving you peace of mind when using them for transactions.

Customizing Your Chase Checks

One of the benefits of ordering checks from Chase Bank is the ability to customize them to suit your personal style and preferences. Customization options include:

- Designs: Choose from a variety of check designs, ranging from classic to contemporary.

- Fonts: Select from different font styles for your personal information.

- Logos: Add a personal or business logo to your checks for a professional touch.

- Colors: Opt for color variations to make your checks stand out.

Customizing your checks allows you to express your individuality while maintaining the functionality and security you expect from Chase Bank. Whether for personal use or business purposes, customized checks can leave a lasting impression on recipients.

Tips for Managing Your Checkbook Effectively

Effectively managing your checkbook is essential for maintaining control over your finances and avoiding potential pitfalls. Here are some tips to help you stay organized:

- Record Transactions: Write down each check transaction in your check register to keep track of your spending.

- Balance Regularly: Reconcile your checkbook with your bank statements regularly to identify discrepancies.

- Store Checks Securely: Keep unused checks in a safe place to prevent unauthorized access.

- Monitor Your Account: Regularly review your bank account for any unusual activity or unauthorized transactions.

- Use Duplicate Checks: Consider using duplicate checks to create an automatic record of each transaction.

By following these tips, you can ensure that your checkbook remains a valuable tool for managing your finances, providing you with clarity and control over your financial activities.

Avoiding Common Mistakes When Ordering Checks

Ordering checks may seem straightforward, but there are common mistakes that customers can make during the process. Being aware of these pitfalls can help you avoid unnecessary issues:

- Incorrect Information: Double-check that your personal and account information is accurate to prevent check rejections.

- Overlooking Costs: Review the costs and fees associated with your order to ensure you're comfortable with the total price.

- Ignoring Security Features: Opt for checks with robust security features to protect against fraud.

- Failing to Track Orders: Keep track of your order status and delivery date to plan for any upcoming transactions.

By avoiding these common mistakes, you can ensure a smooth ordering process and receive your checks without any unexpected complications.

The Environmental Impact of Paper Checks

While checks offer numerous benefits, it's important to consider their environmental impact. The production and use of paper checks contribute to deforestation, energy consumption, and waste generation. Here are some ways to mitigate this impact:

- Opt for Digital Alternatives: Whenever possible, choose digital payment methods to reduce paper usage.

- Recycle Used Checks: Properly dispose of old checks by shredding and recycling them to minimize waste.

- Order Only What You Need: Avoid over-ordering checks to prevent unnecessary paper consumption.

By being mindful of the environmental impact of checks and taking proactive steps to minimize it, you can contribute to a more sustainable future while still enjoying the benefits of this traditional payment method.

Are There Alternatives to Using Checks?

In today's digital era, there are several alternatives to using checks for financial transactions. Some popular options include:

- Electronic Funds Transfer (EFT): Transfer funds directly between bank accounts without the need for checks.

- Credit and Debit Cards: Use cards for convenient and secure payments both in-person and online.

- Mobile Payment Apps: Utilize apps like PayPal, Venmo, or Zelle for quick and easy peer-to-peer transactions.

- Online Bill Pay: Pay bills electronically through your bank's online platform, eliminating the need for checks.

These alternatives offer convenience, speed, and enhanced security, making them attractive options for individuals and businesses looking to streamline their financial activities. However, checks remain a viable choice for those who prefer a tangible record of their transactions or require a paper trail for specific payments.

FAQs About Ordering Checks from Chase Bank

1. How long does it take to receive checks from Chase Bank?

Typically, it takes 7-10 business days for checks to arrive after placing an order with Chase Bank. Expedited shipping options may be available for an additional fee.

2. Can I track my check order status?

Yes, Chase Bank provides tracking information for your check order, allowing you to monitor its status and estimated delivery date.

3. Is there a limit to the number of checks I can order at once?

There is no strict limit, but it's recommended to order only what you need to avoid unnecessary costs and environmental impact.

4. Are there special discounts for ordering checks in bulk?

Chase Bank may offer discounts for ordering checks in larger quantities, reducing the cost per check. Check with the bank for current promotions.

5. Can I customize my checks online?

Yes, you can customize your checks online by selecting from various designs, fonts, and colors to suit your preferences.

6. What should I do if my checks are lost or stolen?

If your checks are lost or stolen, contact Chase Bank immediately to report the issue and prevent unauthorized use of your account.

Conclusion

Ordering checks from Chase Bank is a straightforward process that offers customers a range of options, from online ordering to in-person assistance. With the bank's commitment to security, customization, and customer service, you can confidently manage your financial transactions with checks. While considering the environmental impact of checks, it's also important to explore digital alternatives that offer convenience and efficiency. By staying informed and making thoughtful choices, you can effectively manage your finances and enjoy the benefits of Chase Bank's comprehensive services.