In the realm of credit scores, Experian Boost has emerged as a noteworthy contender. It's a free service offered by Experian, one of the three major credit bureaus, that aims to enhance your credit score by incorporating your utility and telecom payment history. Many individuals are curious about its effectiveness, wondering if it truly delivers on its promise of providing a credit score boost. But before diving into the depths of its efficacy, it's essential to understand the mechanics of Experian Boost and how it operates within the broader credit scoring ecosystem.

Experian Boost breaks away from traditional credit scoring methods by considering non-traditional data. It works by allowing users to add their utility and telecom payments to their credit report. This addition can be particularly beneficial for individuals who pay their bills on time but may not have a substantial credit history. By including these payments, Experian Boost can potentially increase your FICO score, which is widely used by lenders to assess creditworthiness.

However, while Experian Boost sounds promising, it's important to evaluate its effectiveness critically. Does it genuinely provide a significant boost to credit scores? Are there any hidden drawbacks or limitations to this service? As we delve deeper, we'll explore these questions, providing a comprehensive overview of how effective Experian Boost truly is. By assessing various aspects and user experiences, we aim to present a balanced perspective that can guide individuals in making informed decisions about using this service.

Read also:Movierulz 7 2024 Download Your Guide To Safe And Secure Streaming

Table of Contents

- How Does Experian Boost Work?

- What Are the Benefits of Using Experian Boost?

- Are There Any Limitations to Experian Boost?

- How Effective is Experian Boost?

- What Impact Does Experian Boost Have on Your Credit Score?

- User Experiences: Success Stories and Challenges

- How Does Experian Boost Compare to Other Credit Improvement Methods?

- Is Experian Boost Safe and Secure to Use?

- Who is Eligible for Experian Boost?

- Steps to Get Started with Experian Boost

- Tips for Maximizing the Benefits of Experian Boost

- Frequently Asked Questions

- External Resources and Further Reading

- Conclusion: Is Experian Boost Worth It?

How Does Experian Boost Work?

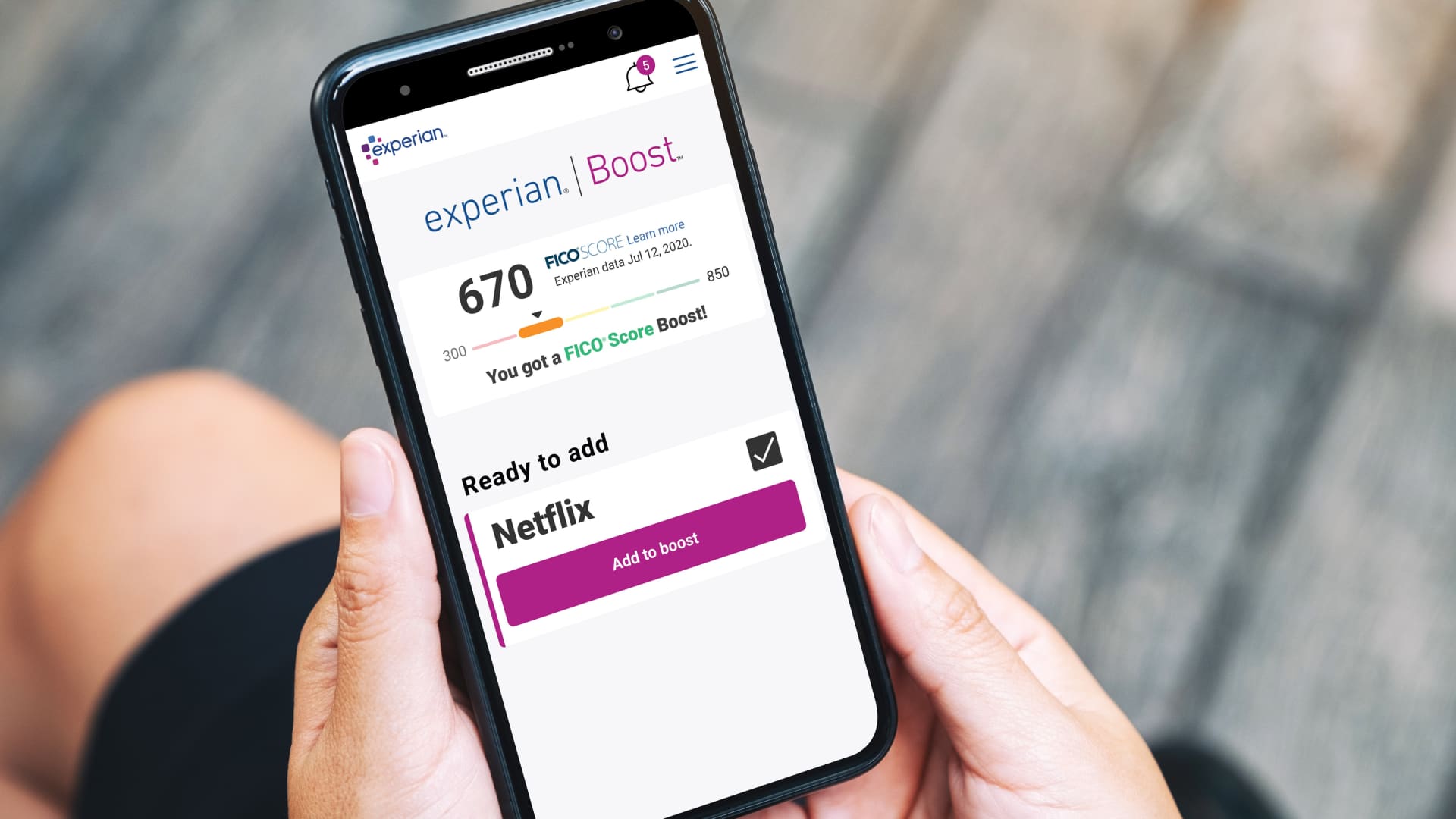

Experian Boost functions by leveraging your utility and telecom payments, integrating this information into your credit profile. This service operates on a simple principle: if you consistently pay your utility bills on time, this can be a reflection of creditworthiness. By granting Experian access to your bank account, it identifies and tracks these payments, subsequently adding them to your Experian credit report.

Once you opt into Experian Boost, the process is relatively straightforward. It begins with connecting your bank account to the Experian Boost platform, allowing it to analyze your financial transactions. The service specifically looks for payments related to utilities, such as electricity and water bills, as well as telecom services, including phone and internet payments. After identifying these payments, Experian Boost adds them to your credit report, potentially raising your FICO score.

It's important to note that Experian Boost only influences your credit report with Experian, not the other major credit bureaus, Equifax and TransUnion. Therefore, any score improvement will solely be reflected in your Experian credit score, which is crucial to remember when considering its overall impact on your credit profile.

Do All Payments Qualify for Experian Boost?

Not all payments are eligible for Experian Boost. The service focuses on particular types of bills that are not traditionally considered in credit scoring. These include:

- Electricity Bills

- Water Bills

- Gas Bills

- Cell Phone Bills

- Internet Bills

- Streaming Services (e.g., Netflix, Hulu)

Payments related to mortgages, credit cards, or personal loans are not included in Experian Boost, as these are already part of the traditional credit scoring model.

How Quickly Does Experian Boost Affect Your Score?

Once you successfully connect your bank account and verify the eligible payments, the impact on your credit score can be immediate. Many users report seeing changes in their Experian credit score within a few minutes of completing the setup process. However, the extent of the score change varies based on individual credit histories and the amount of data available for inclusion.

Read also:Everything You Need To Know About 5movierulz 2023 Download Tamil

What Are the Benefits of Using Experian Boost?

Experian Boost offers several advantages, particularly for individuals with limited credit histories or those looking to improve their credit score quickly. These benefits include:

- Free Service: Experian Boost is entirely free to use, meaning you won't incur any costs for improving your credit score through this method.

- Immediate Impact: Unlike traditional credit-building strategies that may take months to show results, Experian Boost can affect your credit score almost instantly once set up.

- No Negative Impact: Since Experian Boost only adds positive payment history, there's no risk of your score dropping as a result of using the service.

- Leverage Non-Traditional Data: By using utility and telecom payments, individuals with a limited credit profile can benefit from data that would otherwise be overlooked.

- Improved Loan Approval Chances: A higher credit score can enhance your eligibility for loans and credit cards, often at better interest rates.

For those with a thin credit file or who are new to credit, Experian Boost can be a valuable tool in establishing a more robust credit profile. However, it's essential to remember that while Experian Boost is beneficial, it's not a standalone solution for comprehensive credit improvement.

Are There Any Limitations to Experian Boost?

While Experian Boost has its perks, it's not without its limitations. Understanding these can help manage expectations and determine if it's the right choice for your financial strategy.

Does Experian Boost Affect All Credit Scores?

One of the main limitations is that Experian Boost only influences your Experian credit score. Other credit bureaus, such as Equifax and TransUnion, do not account for the data used by Experian Boost. Therefore, any positive changes won't reflect on credit scores calculated by these bureaus.

What About Privacy Concerns?

Using Experian Boost involves sharing your bank account information with Experian, which can raise privacy concerns for some users. Experian assures that the data accessed is read-only and used solely for identifying qualifying payments. However, it's crucial to weigh the potential privacy risks against the benefits before proceeding.

Additionally, Experian Boost might not be beneficial for everyone. If you already have a well-established credit history with a high score, the impact of adding utility and telecom payments might be minimal. Moreover, if your financial transactions don't include eligible payments, Experian Boost won't affect your score.

How Effective is Experian Boost?

Determining the effectiveness of Experian Boost requires analyzing its impact on various users and scenarios. For some, it can be a game-changer, while for others, the results might be negligible.

Can Experian Boost Significantly Increase Your Score?

The effectiveness of Experian Boost largely depends on your existing credit profile. Users with limited credit history or no traditional credit lines might see a more significant score increase. On average, users report a boost of around 10 to 13 points. However, this can vary widely, with some individuals experiencing higher increases and others seeing little to no change.

Is Experian Boost Effective for Everyone?

Experian Boost tends to be more effective for individuals with limited credit history or those who primarily rely on alternative forms of credit. For users with an extensive credit history and a high credit score, the impact might be less pronounced. Additionally, if your payment history doesn't include qualifying payments, Experian Boost won't be effective.

Overall, while Experian Boost can be a valuable tool for improving your credit score, it's not a one-size-fits-all solution. Users should assess their credit profiles and consider whether the benefits align with their financial goals.

What Impact Does Experian Boost Have on Your Credit Score?

When considering how effective Experian Boost is, it's important to examine its impact on your credit score in detail. The primary goal of Experian Boost is to enhance your Experian credit score by incorporating positive payment history that would otherwise be omitted.

Does Experian Boost Affect Your FICO Score?

Experian Boost specifically targets your FICO score, which is a key factor in credit decisions made by lenders. By adding utility and telecom payments to your credit report, Experian Boost can increase your FICO score. However, the extent of this impact varies based on individual financial situations and existing credit profiles.

Can Experian Boost Lower Your Credit Score?

It's important to highlight that Experian Boost is designed to add positive information only. As such, it doesn't have the capacity to lower your credit score. The service does not report negative information, so using it carries no risk of score reduction.

In conclusion, Experian Boost can positively impact your credit score, potentially making you more appealing to lenders. However, the results can vary, and it's essential to consider your unique financial situation when evaluating its effectiveness.

User Experiences: Success Stories and Challenges

Experian Boost has garnered a range of user experiences, from success stories to challenges faced during its implementation. Understanding these experiences can provide valuable insights into how effective Experian Boost is for different individuals.

What Are Some Success Stories?

Many users have shared positive experiences with Experian Boost, highlighting significant improvements in their credit scores. For instance, some individuals have reported score increases of up to 20 points, which have helped them secure better loan terms and credit card offers. These success stories often come from users with limited credit histories who benefit from the addition of alternative payment data.

Are There Any Common Challenges?

While there are numerous success stories, some users have faced challenges with Experian Boost. Common issues include difficulty connecting bank accounts, transactions not being recognized as eligible payments, and minimal score changes. Additionally, some users express concerns about the privacy and security of their financial data, despite Experian's assurances.

Overall, user experiences with Experian Boost vary widely. While many find it beneficial, others may encounter obstacles that limit its effectiveness. It's crucial to consider these experiences when deciding whether to use the service.

How Does Experian Boost Compare to Other Credit Improvement Methods?

Experian Boost is one of several tools available for improving credit scores. Comparing it to other methods can help determine its relative effectiveness and suitability for your financial goals.

How Does Experian Boost Compare to Traditional Credit Building?

Traditional credit-building methods often involve opening credit accounts, such as credit cards or loans, and demonstrating responsible usage over time. While effective, these methods can take months or even years to show significant results. In contrast, Experian Boost offers a more immediate impact by adding alternative payment data.

Experian Boost vs. Credit Repair Services: Which is Better?

Credit repair services typically focus on disputing negative information on your credit report and negotiating with creditors. These services can be effective for addressing specific issues, but they often come with fees and require more time. Experian Boost, being free and quick to implement, can be a more accessible option for individuals looking to enhance their scores without major issues on their reports.

Ultimately, the choice between Experian Boost and other credit improvement methods depends on your unique financial situation and goals. For those seeking a quick boost with minimal effort, Experian Boost can be a valuable option.

Is Experian Boost Safe and Secure to Use?

Security and privacy concerns are paramount when using financial services like Experian Boost. Understanding the safety measures in place can help alleviate these concerns and determine if the service is right for you.

What Security Measures Does Experian Boost Implement?

Experian Boost employs several security measures to protect user data. The service uses bank-level encryption to safeguard financial information and ensures that the data accessed is read-only. This means Experian cannot make changes to your account or transactions, limiting the risk of unauthorized access.

Are There Any Risks Involved with Experian Boost?

While Experian Boost is designed to be secure, no system is entirely risk-free. The primary risk involves sharing your bank account information with Experian, which may not be comfortable for all users. It's essential to weigh these risks against the potential benefits and decide if Experian Boost aligns with your security preferences.

Overall, Experian Boost is considered safe and secure for most users. However, it's crucial to remain vigilant and take precautions, such as regularly monitoring your accounts, to ensure continued security.

Who is Eligible for Experian Boost?

Determining eligibility for Experian Boost is a crucial step in understanding its applicability and effectiveness for various individuals.

What Are the Basic Eligibility Requirements?

To use Experian Boost, you must meet the following criteria:

- Have an active Experian account.

- Be willing to connect your bank account to the Experian Boost platform.

- Have a consistent history of eligible payments reflected in your bank transactions.

Can Anyone Benefit from Experian Boost?

While many individuals can benefit from Experian Boost, its effectiveness varies based on one's credit history and financial habits. Those with limited credit histories or who frequently make eligible payments are likely to see the most significant benefits. Conversely, individuals with an extensive credit profile or those lacking qualifying payments may experience minimal impact.

Ultimately, understanding your eligibility and the potential benefits can help you decide if Experian Boost is a suitable tool for your credit improvement journey.

Steps to Get Started with Experian Boost

Getting started with Experian Boost involves a straightforward process that can be completed in a few simple steps.

How to Set Up Experian Boost?

Follow these steps to set up Experian Boost:

- Create or log in to your Experian account.

- Navigate to the Experian Boost section and select "Get Started."

- Connect your bank account to the platform by following the prompts.

- Review and verify the eligible payments identified by Experian Boost.

- Confirm the addition of these payments to your credit report.

What Should You Do After Setting Up Experian Boost?

After setting up Experian Boost, it's essential to monitor your credit score and report regularly. This helps ensure accuracy and identify any potential issues that may arise. Additionally, consider combining Experian Boost with other credit improvement strategies for a more comprehensive approach to enhancing your credit profile.

By following these steps, you can effectively leverage Experian Boost to improve your credit score and achieve your financial goals.

Tips for Maximizing the Benefits of Experian Boost

To make the most of Experian Boost, consider implementing these tips to maximize its benefits.

How Can You Enhance the Effectiveness of Experian Boost?

Enhancing the effectiveness of Experian Boost involves strategic planning and consistent financial habits. Here are some tips to consider:

- Ensure Regular Eligible Payments: Maintain consistent payments for qualifying services, such as utilities and telecom bills, to create a robust payment history.

- Combine with Traditional Credit Building: Use Experian Boost alongside traditional credit-building methods, such as responsibly using credit cards and loans, to create a well-rounded credit profile.

- Monitor Your Credit Report: Regularly check your credit report to ensure accuracy and identify opportunities for improvement.

What Should You Avoid When Using Experian Boost?

While Experian Boost can be beneficial, certain actions can hinder its effectiveness. Avoid the following:

- Ignoring Privacy Concerns: Ensure you are comfortable with sharing your bank account information before proceeding.

- Relying Solely on Experian Boost: Don't rely exclusively on Experian Boost for credit improvement. Combine it with other strategies to achieve the best results.

- Neglecting Financial Responsibilities: Continue to pay all your bills on time and manage your finances responsibly to maintain a positive credit profile.

By following these tips, you can maximize the benefits of Experian Boost and make it an effective tool in your credit improvement journey.

Frequently Asked Questions

1. Does Experian Boost Work with Joint Accounts?

Experian Boost can analyze transactions from joint accounts as long as they meet the eligibility criteria. However, it's essential to ensure that both account holders agree to connect the account to Experian Boost.

2. Will Experian Boost Affect My Credit Score Permanently?

The changes made by Experian Boost can last as long as the qualifying payments continue. If you stop making eligible payments, the boost in your credit score may eventually diminish.

3. Can I Use Experian Boost If I Don't Have a Bank Account?

Unfortunately, Experian Boost requires a bank account to verify eligible payments. Without a bank account, you won't be able to use the service.

4. How Often Should I Use Experian Boost?

Once set up, Experian Boost continuously monitors your transactions for eligible payments, so there's no need for frequent re-evaluation. It's a one-time setup that provides ongoing benefits.

5. Can Experian Boost Hurt My Credit Score?

No, Experian Boost cannot hurt your credit score. It only adds positive payment history and does not report negative information.

6. Is There a Fee for Using Experian Boost?

Experian Boost is a free service, so there are no fees associated with using it to improve your credit score.

External Resources and Further Reading

For more information on credit improvement and Experian Boost, consider exploring these resources:

- Experian: Understanding Your Credit Score

- Consumer Financial Protection Bureau: Credit Reports and Scores

- FICO: Credit Education

Conclusion: Is Experian Boost Worth It?

Experian Boost offers a unique approach to credit improvement by incorporating non-traditional data into your credit report. Its effectiveness varies based on individual credit profiles, but many users find it beneficial, especially those with limited credit histories. While it provides a free and quick way to potentially enhance your credit score, it's not a comprehensive solution for everyone.

Ultimately, whether Experian Boost is worth it depends on your specific financial situation and goals. By understanding its benefits, limitations, and potential impact, you can make an informed decision about using this service as part of your credit improvement strategy.