In today's fast-paced financial world, having a reliable way to manage and access your funds is crucial. One essential tool that helps individuals and businesses alike is the humble check. While digital transactions have become the norm, checks remain a vital part of financial operations. If you're banking with Chase, ordering checks is an efficient and straightforward process that ensures you have the necessary tools for transactions.

Chase Bank, one of the largest financial institutions in the United States, offers a range of services tailored to meet the diverse needs of its customers. Among these services, ordering checks is a simple yet essential task that provides convenience and reliability. Whether you're a business owner keeping track of expenses or an individual managing personal finances, ordering checks from Chase is a seamless process that can be completed with ease.

In this article, we delve into the details of ordering checks through Chase Bank. From understanding the different types of checks available to exploring the benefits and costs involved, we aim to provide a comprehensive guide that covers all aspects of ordering checks. Additionally, we will address common questions and concerns, ensuring that you have all the information needed to make informed decisions when it comes to managing your finances with Chase Bank checks.

Read also:All You Need To Know About Vega Movies Si The Ultimate Guide

Table of Contents

- What are Checks?

- Importance of Checks in Modern Banking

- How to Order Checks from Chase Bank?

- Types of Checks Available at Chase

- Benefits of Ordering Checks from Chase Bank

- Costs Associated with Ordering Checks

- Customizing Your Checks

- Security Features of Chase Bank Checks

- What if I Run Out of Checks?

- How Long Does It Take to Receive Checks?

- Troubleshooting Common Issues

- Frequently Asked Questions

- Conclusion

What are Checks?

Checks are written, dated, and signed instruments that instruct a bank to pay a specific amount of money from a person's account to the person in whose name the check has been issued. They serve as a bill of exchange and are a traditional form of payment used globally. Despite the rise of digital banking, checks remain a staple in personal and business financial transactions due to their tangible nature and traceability.

Importance of Checks in Modern Banking

In the context of modern banking, checks offer several advantages:

- They provide a physical record of payment, which can be useful for budgeting and record-keeping.

- Checks can be used to make payments when electronic methods are unavailable or impractical.

- They offer an added level of security, as checks require a signature and can be canceled if lost or stolen.

Moreover, checks are often preferred for larger transactions or when dealing with institutions that may not accept credit or debit cards. This makes them a versatile tool in both personal and business finance.

How to Order Checks from Chase Bank?

Ordering checks from Chase Bank is a straightforward process. Here’s how you can do it:

- Log into your Chase online banking account.

- Navigate to the "Accounts" section and select the account from which you wish to order checks.

- Click on "More Options" and choose "Order Checks."

- Follow the prompts to select your check style, quantity, and any customization options.

- Review your order and proceed to checkout.

Alternatively, you can order checks by visiting a Chase branch or by calling their customer service line. Each method provides flexibility to suit your preferences and needs.

Types of Checks Available at Chase

Chase Bank offers a variety of checks to cater to different needs:

Read also:5movierulz 2024 Download Telugu Movierulz Guide Everything You Need To Know

- Personal Checks: These are used for everyday transactions and personal use.

- Business Checks: Designed for business transactions and often include additional features such as company logos.

- Cashier’s Checks: These are guaranteed by the bank, offering security for large transactions.

- Certified Checks: Similar to cashier's checks, but funds are drawn from the account holder's account.

Each type of check serves a specific purpose, ensuring that Chase customers can choose the one that best fits their transaction needs.

Benefits of Ordering Checks from Chase Bank

Ordering checks from Chase Bank comes with numerous benefits:

- Convenience: The process is simple and can be done online, over the phone, or at a branch.

- Customization: Customers can personalize their checks with designs, fonts, and messages.

- Security: Chase checks come with built-in security features to protect against fraud.

- Wide Acceptance: Chase checks are recognized and accepted nationwide, making them a reliable payment method.

These benefits make ordering checks from Chase a logical choice for both personal and business banking needs.

Costs Associated with Ordering Checks

The cost of ordering checks from Chase Bank varies based on several factors:

- The type of check you order (e.g., personal, business, cashier's, certified).

- The quantity of checks in the order.

- Any customization or special features requested.

Typically, personal check orders are more affordable than business check orders, and adding custom designs or features may increase the price. Chase often provides clear pricing information during the ordering process, so customers can make informed decisions.

Customizing Your Checks

One of the appealing aspects of ordering checks from Chase is the ability to customize them. Customers can choose from a variety of designs, including:

- Standard layouts with simple, professional designs.

- Artistic designs featuring patterns, images, or themed backgrounds.

- Personal touches such as monograms or special messages.

This flexibility allows individuals and businesses to create checks that reflect their personality or brand identity. Customizing your checks not only makes them unique but also enhances security by making them less susceptible to fraud.

Security Features of Chase Bank Checks

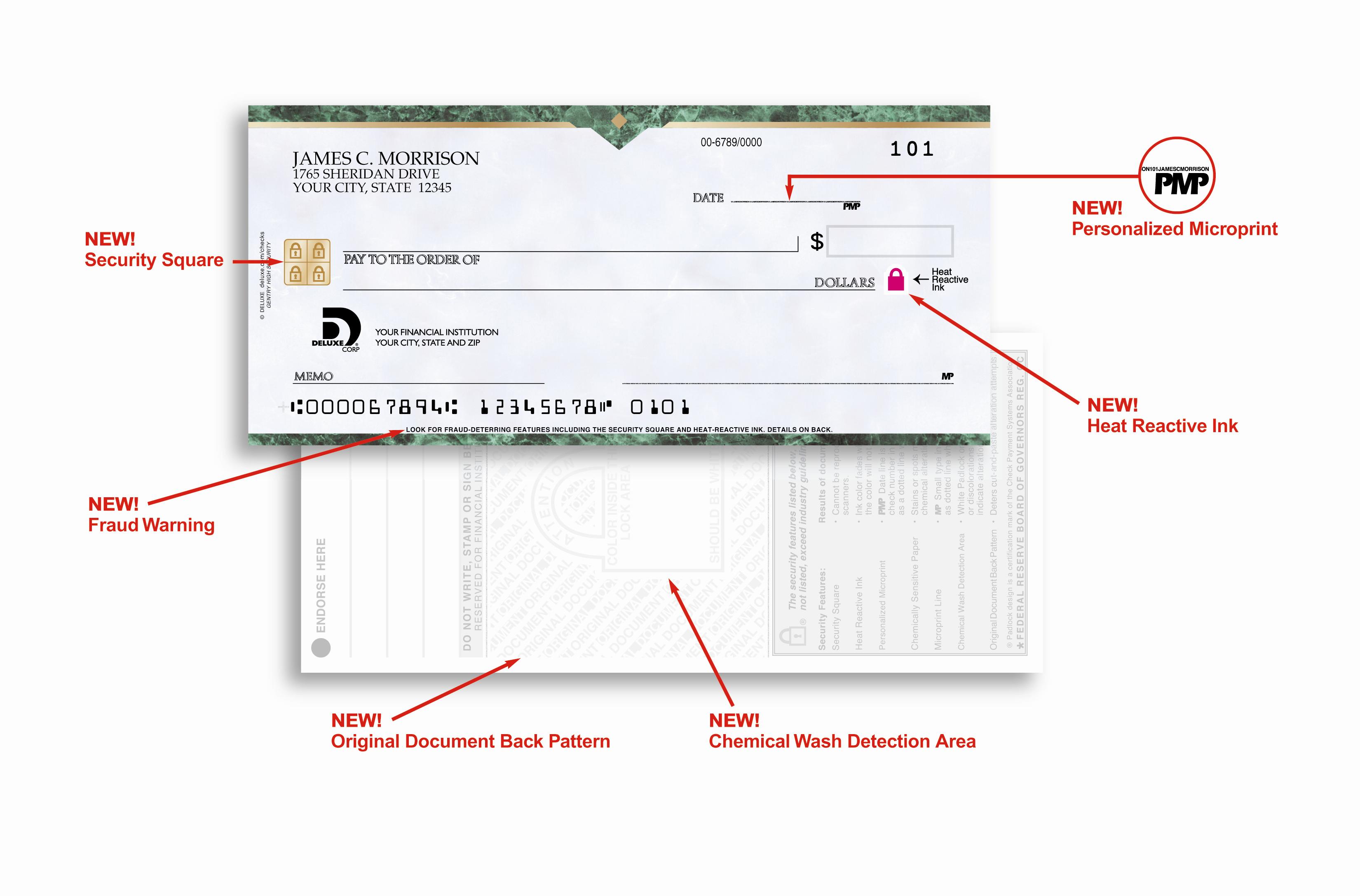

Chase Bank takes security seriously, and their checks come with several features to protect against fraud:

- Watermarks: Embedded designs that are difficult to replicate.

- Microprinting: Tiny text that is clear under magnification and hard to reproduce.

- Special Inks: Inks that change color or disappear when altered.

- Security Screen: A background pattern that reveals "VOID" if photocopied.

These features ensure that Chase checks are secure and provide peace of mind for users conducting transactions.

What if I Run Out of Checks?

If you find yourself running low on checks, ordering more from Chase Bank is a quick and easy process. It's advisable to reorder checks before you completely run out to avoid any disruption in your ability to make payments. Chase offers expedited shipping options for urgent requests, ensuring you receive your checks promptly.

How Long Does It Take to Receive Checks?

The time it takes to receive checks from Chase varies depending on the shipping method selected. Standard delivery typically takes 7-10 business days, while expedited options can reduce this time significantly. Chase provides tracking information for your order, so you can stay updated on its progress and expected delivery date.

Troubleshooting Common Issues

While ordering checks from Chase Bank is generally a smooth process, customers may encounter occasional issues:

- Order Delays: These can occur due to high demand or shipping complications. Check your order status online or contact customer service for updates.

- Incorrect Orders: If you receive the wrong checks, contact Chase immediately to rectify the issue.

- Payment Problems: Ensure your account has sufficient funds to cover the order cost and double-check payment details during the ordering process.

Addressing these issues promptly with Chase’s customer service can help resolve them quickly.

Frequently Asked Questions

How do I reorder checks from Chase?

You can reorder checks from Chase by logging into your online banking account and navigating to the "Order Checks" section, or by visiting a Chase branch or calling customer service.

Can I customize my Chase checks?

Yes, Chase offers customization options for checks, allowing you to choose designs, fonts, and even add personal messages or logos.

How much does it cost to order checks from Chase?

The cost varies depending on the type and quantity of checks, as well as any customization options. Chase provides pricing details during the order process.

What should I do if my checks are lost or stolen?

If your checks are lost or stolen, contact Chase immediately to cancel the checks and prevent unauthorized use. You may also need to order replacements.

Are Chase checks secure?

Yes, Chase checks include multiple security features such as watermarks, microprinting, and security screens to protect against fraud.

Can I order checks for my business account with Chase?

Yes, Chase offers business checks with features tailored to business needs, including options for branding and additional security.

Conclusion

Ordering checks from Chase Bank is an essential service that continues to play a significant role in modern banking. With a variety of check types, customizable options, and robust security features, Chase ensures that customers can manage their finances with ease and confidence. Whether you're balancing personal expenses or handling business transactions, Chase Bank's check ordering service provides the convenience and reliability you need. By understanding the benefits, costs, and processes involved, you can make informed decisions that enhance your banking experience.