The stock market is a dynamic entity, constantly evolving with new challenges and opportunities. Within this realm, Alibaba Group Holding Limited, one of the largest e-commerce conglomerates in the world, remains a focal point of discussion among investors, analysts, and financial enthusiasts. As China’s economic powerhouse, Alibaba's stock has experienced significant fluctuations, prompting intense debates regarding its potential and risks. Amidst these discussions, several key issues have surfaced that are shaping the narrative around Alibaba Group Holding Limited stock. These debates are crucial for investors seeking to understand the complexities surrounding this prominent company. They encompass a range of factors, including regulatory challenges, market competition, and the company's strategic direction.

Investors and analysts often find themselves at crossroads, pondering the potential impact of regulatory scrutiny on Alibaba's future. Moreover, the company’s growth strategies, such as its expansion into international markets and diversification of services, fuel further discourse. As we delve deeper into these debates, it becomes evident that understanding the nuances of Alibaba Group Holding Limited stock is vital for making informed investment decisions. This article aims to provide a comprehensive analysis of these key debates, offering insights into the factors influencing Alibaba’s stock performance.

For those interested in the intricate world of stock investments and the specific case of Alibaba Group Holding Limited, it is essential to grasp these debates to navigate the complexities of the market effectively. By examining the various challenges and opportunities Alibaba faces, investors can gain a clearer perspective on the potential trajectory of the company’s stock. Let us explore these critical discussions and uncover the multifaceted aspects of Alibaba's market presence.

Read also:Chad Kroeger Net Worth An Indepth Analysis Of His Wealth And Career

Table of Contents

- Biography of Alibaba Group Holding Limited

- How Did Alibaba Rise to Prominence?

- What Regulatory Challenges Does Alibaba Face?

- How Does Market Competition Affect Alibaba?

- What Are Alibaba's Strategic Expansion Plans?

- Technological Innovations and Alibaba

- Analyzing Alibaba's Financial Performance

- What Is the Investor Sentiment Around Alibaba?

- Future Predictions for Alibaba's Stock

- What Are the Risks Associated with Investing in Alibaba?

- Alibaba's Global Impact on E-commerce

- Alibaba's Sustainability Efforts

- Key Debates on Alibaba Group Holding Limited Stock

- Frequently Asked Questions

- Conclusion

Biography of Alibaba Group Holding Limited

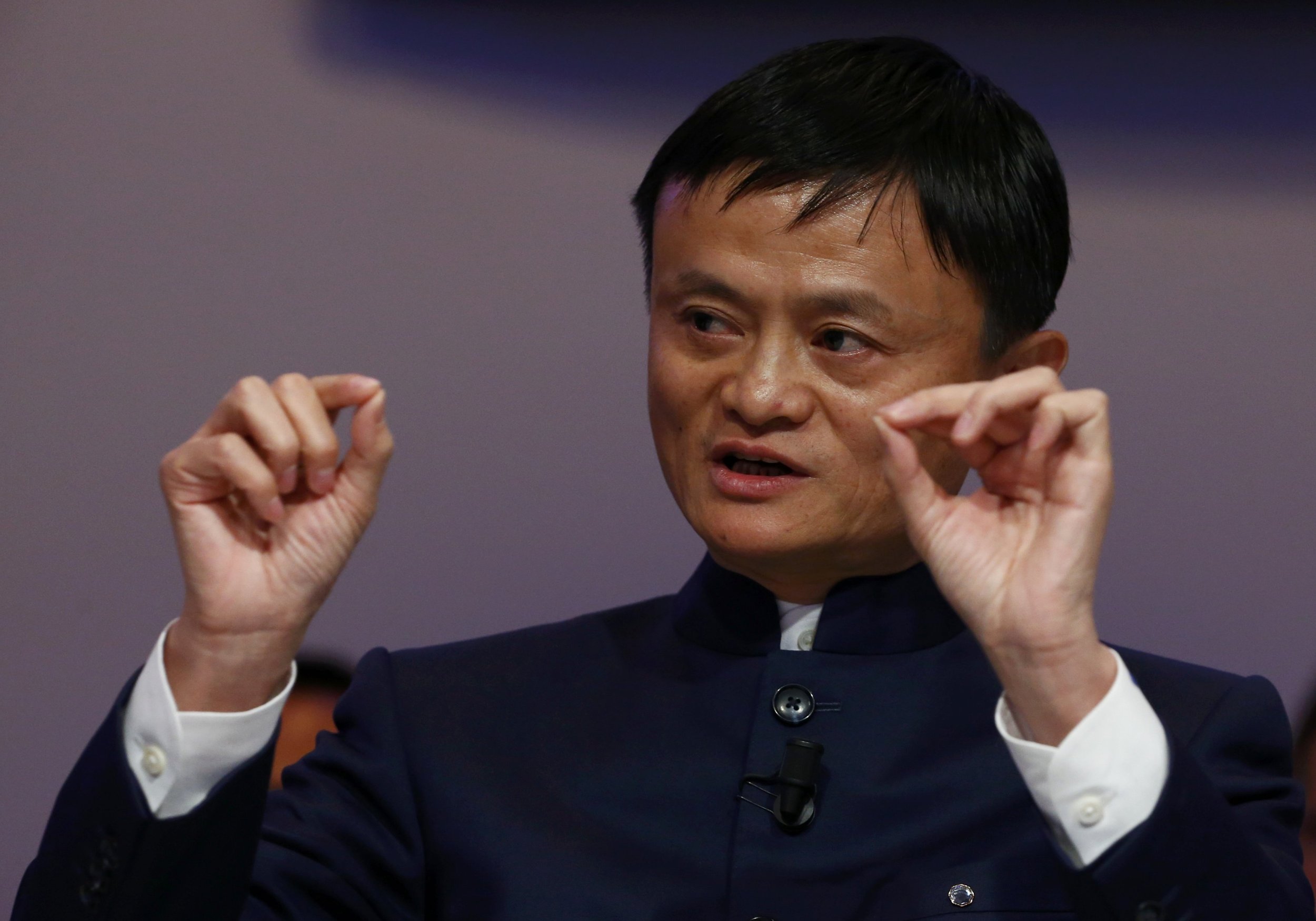

Alibaba Group Holding Limited, founded by Jack Ma and others in 1999, has grown to become a global leader in e-commerce, retail, internet, and technology. Headquartered in Hangzhou, China, Alibaba operates a diverse range of businesses, including online marketplaces, cloud computing, and digital media. The company's mission is to make it easy to do business anywhere.

| Founded | 1999 |

|---|---|

| Headquarters | Hangzhou, China |

| Founder | Jack Ma |

| Key Businesses | E-commerce, Cloud Computing, Digital Media, Technology |

How Did Alibaba Rise to Prominence?

Alibaba's rise to prominence is a story of strategic vision and innovation. The company began as an online marketplace, connecting Chinese manufacturers with international buyers. Over the years, Alibaba expanded its services to include Taobao, Tmall, and AliExpress, catering to both domestic and international consumers. The introduction of Alipay, Alibaba's online payment platform, further solidified its position in the e-commerce sector.

Alibaba's focus on technology-driven solutions, such as cloud computing through Alibaba Cloud, has propelled its growth. Additionally, strategic partnerships and acquisitions have enabled Alibaba to diversify its offerings and enter new markets. This expansion strategy has not only increased its revenue streams but also enhanced its competitive edge in the global market.

What Regulatory Challenges Does Alibaba Face?

Alibaba operates in a complex regulatory environment, particularly in China, where government oversight is stringent. The company has faced antitrust investigations, resulting in fines and increased scrutiny over its business practices. These regulatory challenges have raised concerns about Alibaba's ability to maintain its market dominance.

The Chinese government's focus on curbing monopolistic behavior and ensuring fair competition has led to changes in the regulatory landscape. Alibaba must navigate these regulations while maintaining its competitive advantage. Compliance with data protection laws and consumer rights regulations also remains a priority for the company.

How Does Market Competition Affect Alibaba?

Alibaba faces intense competition from both domestic and international players. In China, companies like JD.com and Pinduoduo pose significant challenges, each offering unique value propositions to consumers. Internationally, giants like Amazon and eBay compete for market share, particularly in regions where Alibaba seeks to expand.

Read also:Everything You Need To Know About 5moviez Rulz The Ultimate Entertainment Hub

To stay ahead, Alibaba continually innovates and adapts its business model. The company invests in technology and infrastructure to enhance user experience and streamline operations. Strategic collaborations and joint ventures further enable Alibaba to strengthen its market position amid fierce competition.

What Are Alibaba's Strategic Expansion Plans?

Alibaba's strategic expansion plans focus on strengthening its presence in key international markets. The company aims to increase its penetration in Southeast Asia, Europe, and North America through initiatives like Lazada, its Southeast Asian e-commerce platform. Alibaba also targets emerging markets with high growth potential.

In addition to geographical expansion, Alibaba is diversifying its business portfolio. The company invests in sectors like artificial intelligence, logistics, and entertainment. By doing so, Alibaba seeks to create new revenue streams and enhance its value proposition to consumers and businesses alike.

Technological Innovations and Alibaba

Alibaba is at the forefront of technological innovation, leveraging cutting-edge technologies to enhance its services and operations. The company's investment in artificial intelligence, machine learning, and big data analytics has transformed its e-commerce platforms, offering personalized experiences to consumers.

Alibaba Cloud, a key component of Alibaba's technology strategy, provides scalable and secure cloud services to businesses worldwide. This innovation not only supports Alibaba's core operations but also generates significant revenue, contributing to the company's overall growth.

Analyzing Alibaba's Financial Performance

Alibaba's financial performance is a crucial aspect of its stock's attractiveness. The company has consistently reported strong revenue growth, driven by its diverse business segments. E-commerce remains the primary revenue generator, complemented by cloud computing and digital media services.

However, Alibaba's financials are not without challenges. Regulatory fines and increased competition have impacted profitability. Investors closely monitor Alibaba's financial reports to assess its ability to sustain growth and navigate market uncertainties.

What Is the Investor Sentiment Around Alibaba?

Investor sentiment toward Alibaba is mixed, influenced by various factors such as regulatory challenges, market competition, and financial performance. While some investors remain optimistic about Alibaba's growth potential and innovation, others express caution due to the uncertainties in the regulatory landscape.

Market analysts often provide differing opinions on Alibaba's stock, reflecting the complexity of the factors at play. The company's ability to address regulatory concerns, maintain competitive advantage, and achieve sustainable growth are key determinants of investor sentiment.

Future Predictions for Alibaba's Stock

Predicting the future trajectory of Alibaba's stock involves analyzing multiple variables, including economic conditions, regulatory developments, and market trends. Analysts offer diverse predictions, with some anticipating continued growth driven by strategic expansion and innovation.

However, potential risks, such as regulatory interventions and intensified competition, could impact Alibaba's stock performance. Investors must weigh these factors and consider Alibaba's long-term strategy when making investment decisions.

What Are the Risks Associated with Investing in Alibaba?

Investing in Alibaba involves several risks, primarily stemming from regulatory challenges and market competition. The company's exposure to China's regulatory environment poses a significant risk, as government interventions could affect its operations and profitability.

Additionally, global economic uncertainties and geopolitical tensions may impact Alibaba's international expansion efforts. Investors should conduct thorough risk analysis and consider diversification strategies to mitigate potential losses.

Alibaba's Global Impact on E-commerce

Alibaba's influence extends beyond China, shaping the global e-commerce landscape. The company's innovative platforms and services have set new standards for online shopping, logistics, and payment solutions. Alibaba's global initiatives promote cross-border trade and support small businesses worldwide.

Through strategic partnerships and investments, Alibaba continues to expand its reach and enhance its global reputation. The company's impact on e-commerce is evident in its ability to connect consumers and businesses across continents, fostering economic growth and technological advancement.

Alibaba's Sustainability Efforts

Alibaba is committed to sustainability, implementing initiatives that promote environmental stewardship and social responsibility. The company focuses on reducing its carbon footprint, enhancing supply chain sustainability, and supporting community development.

Through its corporate social responsibility programs, Alibaba aims to create a positive impact on society and the environment. These efforts align with global sustainability goals and reinforce Alibaba's commitment to being a responsible corporate citizen.

Key Debates on Alibaba Group Holding Limited Stock

The key debates surrounding Alibaba Group Holding Limited stock revolve around several critical issues. These include the impact of regulatory scrutiny, the company's competitive positioning, and its strategic direction. Investors and analysts continue to assess the implications of these debates on Alibaba's stock performance.

Regulatory interventions have raised concerns about Alibaba's growth prospects, prompting discussions on the company's ability to adapt to changing regulations. Additionally, the competitive landscape presents challenges and opportunities for Alibaba, influencing its market strategy and innovation efforts.

As Alibaba navigates these debates, its ability to sustain growth and achieve strategic objectives remains a focal point for investors. Understanding these key debates is essential for making informed decisions about Alibaba Group Holding Limited stock.

Frequently Asked Questions

1. What are the key debates on Alibaba Group Holding Limited stock?

The key debates include regulatory challenges, market competition, and Alibaba's strategic direction.

2. How does Alibaba handle regulatory challenges?

Alibaba navigates regulatory challenges by adapting its business practices and ensuring compliance with government regulations.

3. What is Alibaba's strategy for international expansion?

Alibaba focuses on key markets like Southeast Asia, Europe, and North America, leveraging platforms like Lazada for expansion.

4. How does Alibaba's technological innovation impact its business?

Technological innovation enhances Alibaba's services, offering personalized experiences and supporting its core operations.

5. What risks should investors consider when investing in Alibaba?

Investors should consider regulatory risks, competition, and global economic uncertainties when investing in Alibaba.

6. How does Alibaba contribute to sustainability?

Alibaba implements sustainability initiatives that focus on reducing its carbon footprint and supporting community development.

Conclusion

In conclusion, Alibaba Group Holding Limited stock remains a subject of intense debate, shaped by regulatory challenges, market competition, and strategic initiatives. Understanding these key debates is crucial for investors seeking to navigate the complexities of Alibaba's market presence. As Alibaba continues to innovate and expand, its ability to address these challenges and seize opportunities will determine its future trajectory in the stock market.