Chase checks are an essential tool for managing finances, providing a seamless way to handle transactions with ease and security. Whether you're writing a check to pay a bill, sending money to a friend, or managing a business, understanding how Chase checks work can significantly enhance your financial efficiency. With a rich history and a reputation for reliability, Chase checks have become a staple in many households and businesses across the country. This guide will delve into the intricacies of Chase checks, offering insights into their benefits, uses, and the best practices for utilizing them effectively.

In today's fast-paced world, having a reliable banking partner is crucial, and Chase Bank stands out as a leader in providing comprehensive financial services. Chase checks are part of this offering, designed to meet the needs of both individuals and businesses. From personal checks to business checks, and everything in between, Chase provides a variety of options tailored to your specific needs. In this article, we will explore the different types of Chase checks available, how to order them, and the features that make them a preferred choice for many.

With the advent of digital banking, some may wonder about the relevance of checks in modern finance. However, Chase checks continue to play a vital role in financial transactions, offering a tangible and trustworthy method of payment. They provide a level of security and traceability that digital transactions sometimes lack. By the end of this guide, you'll have a comprehensive understanding of how Chase checks can enhance your financial management, ensuring you make the most of the services offered by Chase Bank.

Read also:Everything You Need To Know About 5moviez Rulz The Ultimate Entertainment Hub

Table of Contents

- The History of Chase Checks

- Why Choose Chase Checks?

- How to Order Chase Checks?

- Different Types of Chase Checks

- How do Chase Checks Work?

- Chase Checks for Business

- Security Features of Chase Checks

- Managing Your Chase Checks

- Common Issues with Chase Checks

- Innovations in Chase Checks

- Frequently Asked Questions

- Conclusion

The History of Chase Checks

Chase Bank, a part of JPMorgan Chase & Co., has a long-standing history of providing reliable financial services. The use of checks as a financial instrument dates back centuries, but it was in the 20th century that Chase began to establish itself as a leader in banking. The evolution of Chase checks reflects the bank's commitment to innovation and customer satisfaction.

In the early days, checks were simple paper documents, but over time, they have evolved to include advanced security features and customization options. Chase checks have adapted to meet the changing needs of consumers, offering both traditional and digital solutions to ensure seamless financial transactions.

Why Choose Chase Checks?

Choosing Chase checks comes with a plethora of benefits:

- Reliability: Chase is a trusted name in banking, known for its stability and customer-centric approach.

- Convenience: With multiple ordering options and customization features, Chase checks are designed for easy use.

- Security: Enhanced security features protect against fraud and unauthorized transactions.

- Comprehensive Services: Access to a wide range of banking services complements the use of Chase checks.

How to Order Chase Checks?

Ordering Chase checks is a straightforward process. Here's how you can do it:

- Log into your Chase online banking account.

- Navigate to the 'Order Checks' section under account services.

- Select the account for which you need checks.

- Choose your preferred check design and quantity.

- Confirm your order and wait for your checks to be delivered.

Alternatively, you can visit a Chase branch or contact customer service to order checks.

Different Types of Chase Checks

Chase offers a variety of checks to cater to different needs:

Read also:5 Movie Rulzz Essential Tips For The Ultimate Film Experience

- Personal Checks: Ideal for everyday transactions and personal use.

- Business Checks: Designed for companies, with features tailored to business needs.

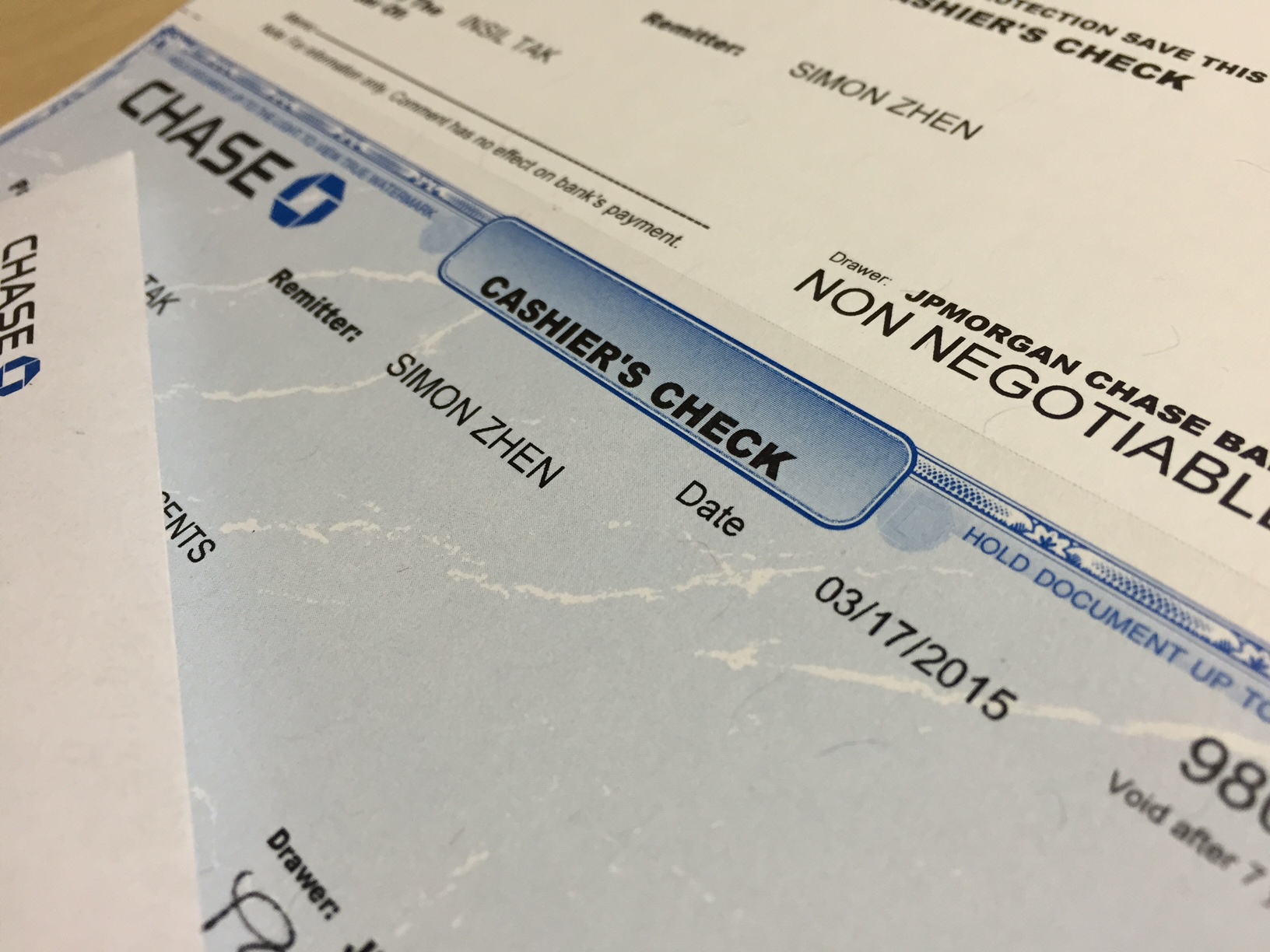

- Cashier's Checks: Used for significant transactions, offering guaranteed funds.

- Certified Checks: Similar to cashier's checks, but funds are drawn from personal accounts.

How do Chase Checks Work?

When you write a Chase check, you're authorizing the bank to transfer a specified amount of money from your account to the recipient. The process involves:

- Writing the date, amount, and recipient's name on the check.

- Signing the check to validate the transaction.

- The recipient deposits or cashes the check, prompting Chase to process the payment.

Chase Checks for Business

Businesses benefit significantly from using Chase checks, thanks to features like:

- Customizable checks with company logos and details.

- Multiple security features to prevent fraud.

- Integration with Chase's online banking for seamless account management.

Security Features of Chase Checks

Chase checks are equipped with advanced security features to safeguard against fraud. These include:

- Watermarks and security threads to prevent counterfeiting.

- Microprinting and chemical protection to deter alterations.

- Unique check numbers for traceability.

Managing Your Chase Checks

Effective management of your Chase checks involves:

- Keeping track of check numbers and transactions.

- Regularly reconciling your checkbook with bank statements.

- Promptly reporting lost or stolen checks to Chase.

Common Issues with Chase Checks

Some common issues users face with Chase checks include:

- Checks bouncing due to insufficient funds.

- Delays in check processing.

- Checks getting lost in the mail.

To mitigate these issues, ensure you have adequate funds before writing a check and consider using trackable mail for delivery.

Innovations in Chase Checks

Chase continually innovates to improve the check-writing experience. Recent advancements include:

- Mobile check deposit, allowing you to deposit checks using your smartphone.

- Enhanced digital security features for online check transactions.

- Integration with financial management apps for better budgeting and tracking.

Frequently Asked Questions

How long does it take for a Chase check to clear?

Typically, Chase checks clear within one to two business days. However, the exact time may vary based on the type of check and bank policies.

Can I order Chase checks online?

Yes, you can easily order Chase checks through your online banking account or the Chase mobile app.

What should I do if I lose a Chase check?

If you lose a Chase check, contact Chase customer service immediately to stop payment and prevent unauthorized transactions.

Are there fees associated with Chase checks?

Chase may charge fees for ordering checks or for special types of checks like cashier's checks. It's advisable to check with the bank for specific fee details.

Can I customize my Chase checks?

Yes, Chase offers customization options for both personal and business checks, allowing you to add logos and personal details.

What is the difference between a cashier's check and a certified check?

A cashier's check is guaranteed by the bank, while a certified check is drawn from your account with the bank's confirmation of funds availability.

Conclusion

Chase checks remain a vital tool in the world of finance, offering a reliable and secure method for managing transactions. Whether for personal use or business purposes, understanding the features and benefits of Chase checks can greatly enhance your financial management strategy. With continued innovations and a commitment to customer satisfaction, Chase checks are poised to remain a staple in financial transactions for years to come. By leveraging the services and features provided by Chase, you can ensure your financial dealings are handled with the utmost efficiency and security.