As we approach the fiscal year 2024, understanding the intricacies of the new tax brackets becomes crucial. The tax brackets for 2024 have been adjusted to accommodate inflation and reflect changes in the economy, affecting millions of taxpayers across the United States. Navigating these changes can be overwhelming, but with a clear understanding of how these brackets are structured, you can make informed decisions to optimize your financial planning and tax liabilities. This guide aims to shed light on the essential components of the 2024 tax brackets to help you prepare effectively.

Tax brackets are the government's way of categorizing income levels to determine the rate at which each segment of income is taxed. They are progressive, meaning that the more you earn, the higher the percentage of tax you pay on your income. The 2024 tax brackets reflect adjustments for inflation, which can impact deductions, credits, and the overall amount of tax that individuals and businesses owe to the government. Whether you're a seasoned taxpayer or filing for the first time, understanding these brackets is key to ensuring compliance and optimizing your tax return.

In this comprehensive guide, we'll cover everything you need to know about the 2024 tax brackets, including how they work, the factors that influence them, and strategies to minimize your tax burden. We'll explore various income levels, filing statuses, and the potential impact of deductions and credits on your taxable income. By the end of this article, you'll be equipped with the knowledge to navigate the tax season with confidence and ease.

Read also:5movierulz 2024 Download Telugu Movierulz Guide Everything You Need To Know

Table of Contents

- How Do Tax Brackets Work?

- What Changes Can We Expect in 2024?

- Understanding Filing Statuses

- Tax Brackets for Single Filers

- Tax Brackets for Married Filing Jointly

- Tax Brackets for Married Filing Separately

- Tax Brackets for Head of Household

- Tax Brackets for Trusts and Estates

- How Inflation Affects Tax Brackets?

- Strategies to Minimize Tax Burden

- Understanding Deductions and Credits

- Impact of Tax Reforms

- How Does the IRS Calculate Taxes?

- Frequently Asked Questions

- Conclusion

How Do Tax Brackets Work?

Tax brackets are a fundamental part of the federal income tax system in the United States. They determine how much tax you owe based on your taxable income. The U.S. tax system is progressive, meaning the rate of tax increases as your income increases. This system is designed to ensure that those who earn more pay a higher percentage of their income in taxes.

Each bracket corresponds to a range of income levels and is taxed at a specific rate. For example, in 2024, the lowest tax bracket might start at 10%, while the highest could reach up to 37%. It's important to note that moving into a higher tax bracket doesn't mean all of your income is taxed at that higher rate. Instead, only the income within each bracket is taxed at its respective rate.

Here's a simplified breakdown of how this works:

- You earn $60,000 in a year.

- The first $10,000 is taxed at 10%.

- The next $30,000 is taxed at 12%.

- The remaining $20,000 is taxed at 22%.

This system ensures that everyone pays the same rate on the same amount of income, which helps maintain fairness and equity in taxation. Understanding how tax brackets work is essential for effective tax planning and ensuring you're not overpaying or underpaying your taxes.

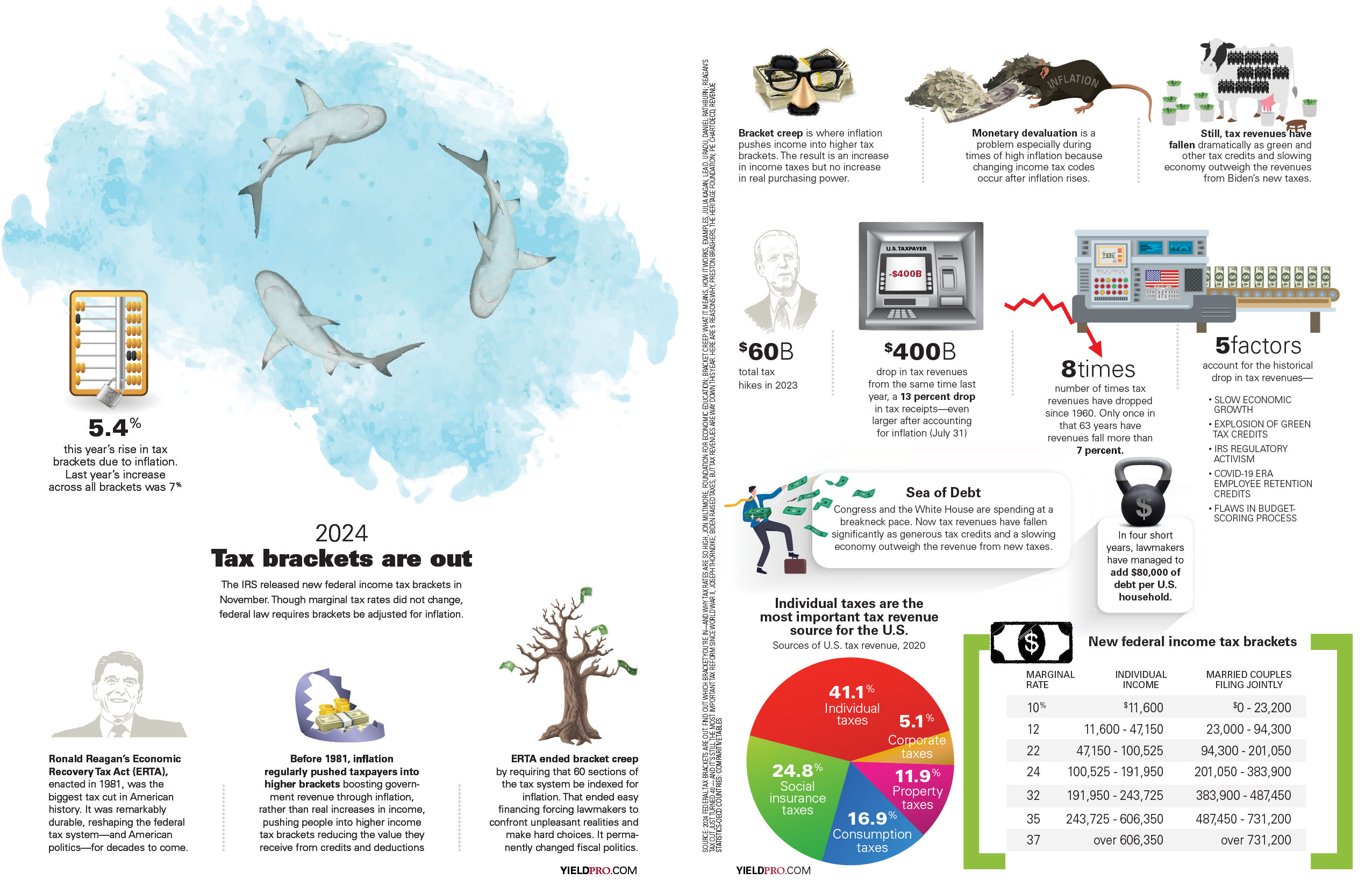

What Changes Can We Expect in 2024?

The tax brackets for 2024 have undergone several changes to accommodate inflation and economic shifts. These adjustments are intended to provide relief to taxpayers and ensure that the tax system remains fair and equitable. Some of the key changes include:

- Adjustment for Inflation: The income thresholds for each tax bracket have been adjusted to account for inflation, which helps prevent "bracket creep," where taxpayers are pushed into higher tax brackets due to increases in income that aren't matched by real increases in purchasing power.

- Changes in Standard Deductions: The standard deduction amounts have been increased, allowing taxpayers to reduce their taxable income without itemizing deductions.

- Updated Tax Credits: Several tax credits, such as the Child Tax Credit and Earned Income Tax Credit, have been revised to provide additional benefits to eligible taxpayers.

These changes are designed to provide more financial flexibility and support to individuals and families, particularly those in lower and middle-income brackets. Staying informed about these updates is crucial for maximizing your tax return and minimizing your tax liability.

Read also:Julie Neal Pitt A Life Of Purpose And Inspiration

Understanding Filing Statuses

Your filing status is a critical factor that influences your tax liability and eligibility for various deductions and credits. There are five primary filing statuses recognized by the IRS:

- Single: This status applies if you are unmarried or legally separated on the last day of the year.

- Married Filing Jointly: Couples who are married at the end of the tax year may choose to file a joint return, combining their income and deductions.

- Married Filing Separately: Married couples may choose to file separate returns, which can sometimes result in a lower tax liability.

- Head of Household: This status is available to unmarried individuals who pay more than half the cost of maintaining a home for themselves and a qualifying person.

- Qualifying Widow(er) with Dependent Child: This status applies to individuals who have lost a spouse and have a dependent child, allowing them to use the Married Filing Jointly rates for two years after the spouse's death.

Choosing the correct filing status is crucial for determining your tax rate, standard deduction, and eligibility for specific credits. Each status has its own set of requirements and benefits, so it's important to evaluate your personal situation and potentially consult with a tax professional to make the best choice.

Tax Brackets for Single Filers

For single filers, the 2024 tax brackets offer a range of income levels and corresponding tax rates. Understanding these brackets is essential for accurately calculating your tax liability and planning your financial future. The following table outlines the tax rates and income thresholds for single filers in 2024:

| Tax Rate | Income Range |

|---|---|

| 10% | $0 - $10,275 |

| 12% | $10,276 - $41,775 |

| 22% | $41,776 - $89,075 |

| 24% | $89,076 - $170,050 |

| 32% | $170,051 - $215,950 |

| 35% | $215,951 - $539,900 |

| 37% | $539,901 and above |

These brackets reflect the progressive nature of the U.S. tax system, where higher income levels are taxed at higher rates. Single filers should consider how their income fits within these brackets and explore deductions and credits that can reduce their taxable income.

Tax Brackets for Married Filing Jointly

Couples who choose to file their taxes jointly can benefit from different tax brackets and potentially lower tax rates. The 2024 tax brackets for married couples filing jointly are as follows:

| Tax Rate | Income Range |

|---|---|

| 10% | $0 - $20,550 |

| 12% | $20,551 - $83,550 |

| 22% | $83,551 - $178,150 |

| 24% | $178,151 - $340,100 |

| 32% | $340,101 - $431,900 |

| 35% | $431,901 - $647,850 |

| 37% | $647,851 and above |

Filing jointly allows couples to combine their incomes and potentially benefit from a lower overall tax rate. It's important for married couples to evaluate their combined income and consider any applicable deductions or credits to optimize their tax situation.

Tax Brackets for Married Filing Separately

Married couples may choose to file separate returns for various reasons, including differing income levels or personal preferences. The 2024 tax brackets for married individuals filing separately are structured to reflect these choices:

| Tax Rate | Income Range |

|---|---|

| 10% | $0 - $10,275 |

| 12% | $10,276 - $41,775 |

| 22% | $41,776 - $89,075 |

| 24% | $89,076 - $170,050 |

| 32% | $170,051 - $215,950 |

| 35% | $215,951 - $323,925 |

| 37% | $323,926 and above |

Filing separately can sometimes result in a higher total tax liability, but it may be advantageous for couples with significant differences in income or specific financial circumstances. It's important to carefully evaluate this option and consult a tax professional if needed.

Tax Brackets for Head of Household

The head of household status is designed for unmarried individuals who maintain a home for themselves and a qualifying person. The 2024 tax brackets for head of household filers provide specific income thresholds and tax rates:

| Tax Rate | Income Range |

|---|---|

| 10% | $0 - $14,650 |

| 12% | $14,651 - $55,900 |

| 22% | $55,901 - $89,050 |

| 24% | $89,051 - $170,050 |

| 32% | $170,051 - $215,950 |

| 35% | $215,951 - $539,900 |

| 37% | $539,901 and above |

This status offers a higher standard deduction and more favorable tax rates compared to the single filing status, reflecting the additional financial responsibilities of maintaining a household. Understanding these brackets can help head of household filers optimize their tax returns.

Tax Brackets for Trusts and Estates

Trusts and estates have their own set of tax brackets, which are generally more compressed than those for individual taxpayers. The 2024 tax brackets for trusts and estates are as follows:

| Tax Rate | Income Range |

|---|---|

| 10% | $0 - $2,750 |

| 24% | $2,751 - $9,850 |

| 35% | $9,851 - $13,450 |

| 37% | $13,451 and above |

Trusts and estates are subject to higher tax rates on a smaller range of income, making it essential for trustees and estate planners to carefully manage distributions and tax liabilities. Understanding these brackets is crucial for effective trust administration and estate planning.

How Inflation Affects Tax Brackets?

Inflation plays a significant role in shaping tax brackets, as it affects the purchasing power of money and the real value of income. To prevent taxpayers from being unfairly pushed into higher tax brackets due to inflation, the IRS adjusts the income thresholds for each bracket annually. This process is known as "indexing for inflation."

The adjustments for inflation are based on the Consumer Price Index (CPI), which measures the average change in prices over time. By aligning tax brackets with inflation, the IRS ensures that taxpayers are not penalized for earning more in nominal terms without a corresponding increase in real purchasing power.

For example, if inflation results in a 3% increase in prices, the income thresholds for each tax bracket will typically be adjusted upward by a similar percentage. This adjustment helps maintain the fairness and equity of the tax system by ensuring that taxpayers are not unfairly burdened by inflation.

Strategies to Minimize Tax Burden

Minimizing your tax burden requires careful planning and strategic decision-making. Here are some effective strategies to consider:

- Maximize Retirement Contributions: Contributing to retirement accounts, such as 401(k)s or IRAs, can reduce your taxable income and provide long-term financial benefits.

- Utilize Tax Credits: Explore available tax credits, such as the Earned Income Tax Credit or Child Tax Credit, to reduce your tax liability.

- Consider Itemizing Deductions: If your itemized deductions exceed the standard deduction, itemizing can lead to significant tax savings.

- Plan Charitable Contributions: Donating to qualified charities not only supports good causes but also provides potential tax deductions.

- Evaluate Investment Strategies: Consider tax-efficient investment options, such as tax-advantaged accounts or municipal bonds, to minimize capital gains taxes.

Implementing these strategies can help you effectively manage your tax liability and optimize your financial situation. It's important to tailor your approach to your specific circumstances and consult with a tax professional if needed.

Understanding Deductions and Credits

Deductions and credits play a crucial role in reducing your taxable income and overall tax liability. Understanding the difference between these two concepts is essential for maximizing your tax return:

- Deductions: Deductions reduce your taxable income by a specific amount, thereby lowering the amount of income subject to tax. Common deductions include mortgage interest, student loan interest, and medical expenses.

- Credits: Credits directly reduce the amount of tax you owe, providing a dollar-for-dollar reduction in your tax liability. Examples of credits include the Child Tax Credit and the American Opportunity Credit.

Both deductions and credits can significantly impact your tax situation, so it's important to explore all available options and determine which ones are applicable to your circumstances. Properly utilizing deductions and credits can lead to substantial tax savings.

Impact of Tax Reforms

Tax reforms can have a significant impact on the structure and rates of tax brackets. Recent reforms, such as the Tax Cuts and Jobs Act (TCJA), have introduced changes that affect individual and corporate tax rates, deductions, and credits. Understanding these reforms is crucial for adapting to new tax laws and optimizing your financial planning.

The TCJA, for example, lowered individual income tax rates, increased the standard deduction, and eliminated certain personal exemptions. These changes have influenced the way taxpayers calculate their liability and plan for the future.

Staying informed about current and upcoming tax reforms is essential for ensuring compliance and making informed financial decisions. It's important to regularly review your tax situation and consult with professionals if needed to navigate these changes effectively.

How Does the IRS Calculate Taxes?

The IRS uses a systematic approach to calculate federal income taxes based on your taxable income and applicable tax brackets. Here's a simplified overview of the process:

- Determine Gross Income: Calculate your total income from all sources, including wages, dividends, and other earnings.

- Subtract Adjustments: Apply any adjustments to income, such as contributions to retirement accounts or student loan interest deductions, to determine your adjusted gross income (AGI).

- Apply Deductions: Choose between the standard deduction and itemized deductions to reduce your AGI and calculate your taxable income.

- Calculate Tax Liability: Use the applicable tax brackets to determine the amount of tax owed on your taxable income.

- Apply Credits: Subtract any applicable tax credits from your tax liability to determine your final tax owed or refund amount.

Understanding this process is crucial for accurately filing your taxes and avoiding potential errors. It's important to maintain accurate records and seek professional assistance if needed to ensure compliance with IRS regulations.

Frequently Asked Questions

What are the 2024 tax brackets?

The 2024 tax brackets are a set of income levels and corresponding tax rates used to calculate federal income tax liability. They are adjusted annually for inflation and vary based on filing status.

How can I find my tax bracket?

You can determine your tax bracket by calculating your taxable income and comparing it to the income thresholds for your filing status in the 2024 tax brackets.

What is the difference between a deduction and a credit?

A deduction reduces your taxable income, while a credit directly reduces the amount of tax you owe. Credits provide a dollar-for-dollar reduction in tax liability.

Should I file jointly or separately if I'm married?

The decision to file jointly or separately depends on your financial situation and tax goals. Filing jointly often results in lower tax rates, but filing separately may be advantageous in certain circumstances.

How do tax reforms affect tax brackets?

Tax reforms can introduce changes to tax rates, deductions, and credits, impacting the structure and application of tax brackets. It's important to stay informed about current and upcoming reforms.

What should I do if I have questions about my taxes?

If you have questions about your taxes, consider consulting with a tax professional or utilizing IRS resources to ensure accurate and compliant filing.

Conclusion

Understanding the 2024 tax brackets is essential for effective tax planning and financial management. By familiarizing yourself with the income thresholds, filing statuses, and applicable deductions and credits, you can optimize your tax return and minimize your tax liability. Whether you're filing as an individual, a couple, or managing a trust or estate, staying informed about the latest tax laws and strategies is crucial for ensuring compliance and achieving your financial goals. As the new tax season approaches, take the time to review your financial situation, explore available resources, and seek professional assistance if needed to navigate the complexities of the tax system with confidence.