Every year, taxpayers in Colorado receive a crucial document known as the 1099-G form. This document reports any government payments made to you, such as unemployment benefits or state tax refunds. Understanding and properly managing your 1099-G form is essential for accurate tax filing and avoiding any potential issues with the IRS. Many residents often find themselves puzzled over the specifics of the 1099-G form, wondering how it impacts their tax returns.

In Colorado, the 1099-G form is not only a statement of the previous year's earnings related to government payments, but it also serves as a key document for tax filing. If you received unemployment benefits or a state tax refund, the 1099-G form is vital for reporting this income to the IRS. Misinterpreting this form can lead to discrepancies in your tax filings, potentially resulting in penalties or audits. Thus, gaining a clear understanding of the 1099-G Colorado form is essential for every taxpayer in the state.

The purpose of this article is to provide a detailed, step-by-step guide on how to handle the 1099-G form in Colorado. We will cover everything from the specifics of the form, its implications on your taxes, and how to report it correctly. Additionally, we'll delve into common questions that arise concerning the 1099-G form, ensuring you are well-equipped to manage your taxes efficiently. Armed with this comprehensive guide, you can approach tax season with confidence, knowing that you have the knowledge needed to navigate your 1099-G Colorado form effectively.

Read also:Understanding Trigonal Pyramidal Angle A Comprehensive Guide

Table of Contents

- What is the 1099-G Colorado Form?

- Understanding the Different Sections of the 1099-G Form

- How Does the 1099-G Impact Your Taxes?

- Steps to Correctly Report Your 1099-G

- Common Mistakes to Avoid When Handling 1099-G

- What if You Did Not Receive a 1099-G?

- How to Correct Errors in Your 1099-G?

- Frequently Asked Questions about 1099-G Colorado

- Conclusion

What is the 1099-G Colorado Form?

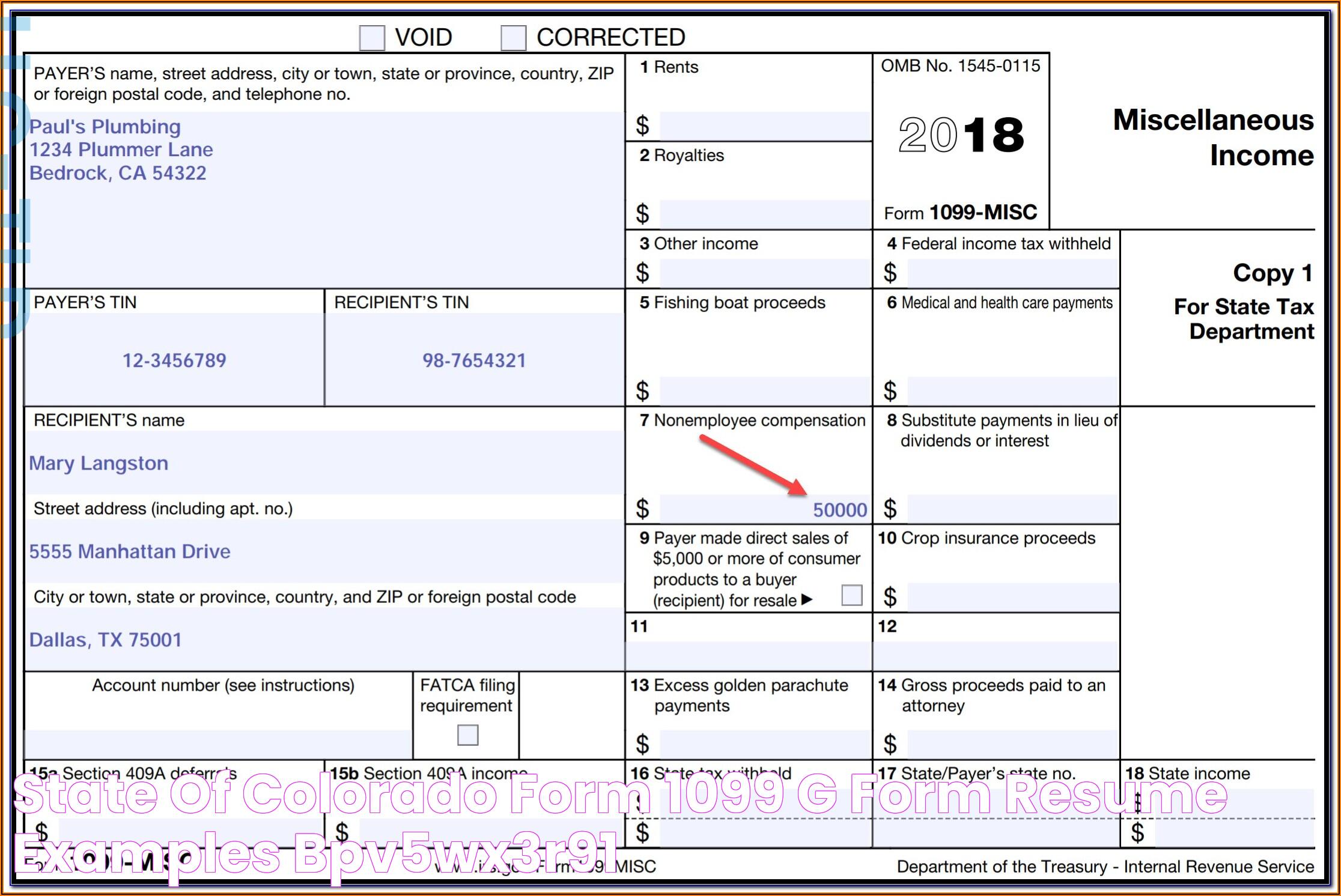

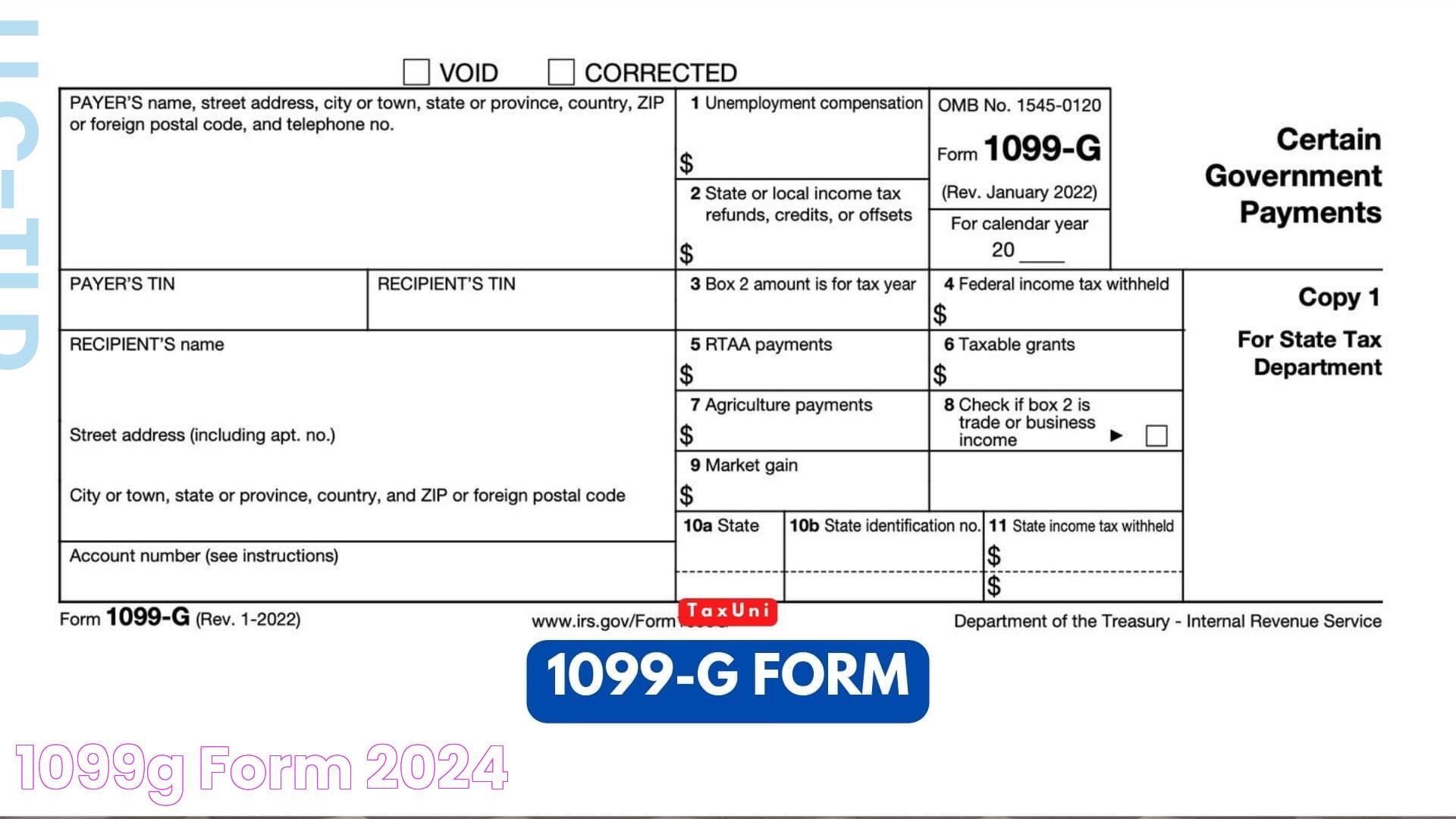

The 1099-G form is an IRS tax form used to report certain types of government payments. In Colorado, this form is primarily used to report unemployment compensation, state or local income tax refunds, and other government payments. For residents of Colorado, the 1099-G form is a critical document during tax season as it impacts how individuals report income and file their taxes.

Typically, the Colorado Department of Labor and Employment issues the 1099-G form to individuals who received unemployment benefits. Aside from unemployment benefits, if you received a state or local tax refund, you might also receive a 1099-G form. This form is sent out at the beginning of the year, and it’s essential to ensure that the information reported matches your records to avoid any discrepancies when filing your taxes.

Key Features of the 1099-G Form

- Reports unemployment compensation and tax refunds.

- Issued by the Colorado Department of Revenue or Department of Labor.

- Essential for accurate tax filing and compliance with IRS regulations.

The significance of the 1099-G form in Colorado is underscored by its role in ensuring taxpayers report all income accurately. Understanding the form’s components and implications is vital for every taxpayer in the state.

Understanding the Different Sections of the 1099-G Form

The 1099-G form consists of several sections, each detailing specific types of payments or refunds. It’s crucial to comprehend these sections to report your income accurately. The form generally includes:

Section 1: Unemployment Compensation

This section reports the total amount of unemployment compensation you received during the previous year. It is one of the most critical parts of the 1099-G form, as unemployment benefits are considered taxable income.

Section 2: State or Local Income Tax Refunds

In this section, any state or local income tax refunds you received are reported. These refunds are only taxable if you deducted them as part of your itemized deductions the previous year.

Read also:The Art And Science Of Water Stain Removal Techniques And Tips

Section 3: Additional Government Payments

This section covers any other government payments you may have received, such as agricultural payments or taxable grants. It’s less common but still important to review if applicable.

Properly understanding each section of the 1099-G form ensures that you accurately report your income and stay compliant with IRS guidelines.

How Does the 1099-G Impact Your Taxes?

The 1099-G form plays a significant role in how your taxes are calculated and filed. It directly impacts your taxable income, which in turn affects your overall tax liability. Here’s how the 1099-G form can influence your taxes:

- Unemployment Compensation: Unemployment benefits are considered taxable income. Therefore, the amount reported on your 1099-G form must be included in your gross income when filing taxes.

- State or Local Tax Refunds: These refunds may be taxable if you itemized your deductions the previous year and received a tax benefit from the deduction.

- Accuracy in Reporting: Ensuring that the amounts on your 1099-G form are accurately reported is crucial for avoiding discrepancies that could lead to audits or penalties.

By understanding how the 1099-G form affects your taxes, you can better prepare for the tax season and take steps to minimize your tax liability.

Steps to Correctly Report Your 1099-G

Reporting your 1099-G form accurately is essential for compliance and avoiding potential tax issues. Here’s a step-by-step guide on how to correctly report your 1099-G form:

- Review the Form: Begin by carefully reviewing the 1099-G form you’ve received. Ensure that all the information, such as your name, Social Security Number, and payment amounts, is accurate.

- Include in Gross Income: Add the unemployment compensation amount from your 1099-G form to your gross income on your tax return. This is essential for accurate tax calculation.

- Determine Tax Refund Taxability: If you received a state or local tax refund, determine if it is taxable. This depends on whether you itemized your deductions in the previous year.

- Report on the Correct Tax Form: Use the appropriate tax forms, such as Form 1040, to report the income detailed in your 1099-G.

- Seek Professional Advice if Needed: If you’re uncertain about how to report your 1099-G, consider seeking advice from a tax professional to ensure compliance and accuracy.

Following these steps can help you accurately report your 1099-G and avoid any potential issues with the IRS.

Common Mistakes to Avoid When Handling 1099-G

Mishandling the 1099-G form can lead to errors on your tax return and potential penalties. Here are some common mistakes to avoid:

- Ignoring the Form: Failing to report the income detailed in your 1099-G form can lead to significant tax issues.

- Incorrectly Reporting Refunds: Misreporting state or local tax refunds can result in underreporting your income.

- Not Verifying Information: Always check the accuracy of the information on your 1099-G form, such as payment amounts and personal details.

- Failing to Include Unemployment Compensation: Ensure that unemployment benefits are included in your gross income.

By being aware of these common pitfalls, you can avoid mistakes and ensure a smooth tax filing process.

What if You Did Not Receive a 1099-G?

If you didn’t receive a 1099-G form but believe you should have, it’s important to take action promptly. Here’s what you should do:

- Contact the Issuing Agency: Reach out to the Colorado Department of Labor and Employment or the Department of Revenue to request a copy of your 1099-G form.

- Check for Errors: Verify that your contact information is correct with the issuing agency to ensure the form is sent to the right address.

- Access Online Resources: Many agencies offer online access to tax documents, including the 1099-G form. Check their website for more information.

Taking these steps can help you obtain your 1099-G form and ensure accurate tax reporting.

How to Correct Errors in Your 1099-G?

If you find errors on your 1099-G form, it’s crucial to correct them to avoid issues with your tax return. Here’s how to address errors on your 1099-G form:

- Contact the Issuer: Reach out to the Colorado Department of Labor and Employment or the Department of Revenue to report the error and request a corrected form.

- Document the Error: Keep documentation of the error and any correspondence with the issuing agency for your records.

- File an Amended Return if Necessary: If you’ve already filed your tax return with the incorrect information, you may need to file an amended return using Form 1040-X.

Addressing errors promptly can help you maintain compliance and avoid any potential tax penalties.

Frequently Asked Questions about 1099-G Colorado

What is the deadline for receiving the 1099-G form?

The 1099-G form is typically sent out by January 31st each year. If you haven’t received it by this date, contact the issuing agency.

Are unemployment benefits taxable in Colorado?

Yes, unemployment benefits are considered taxable income both federally and in the state of Colorado.

Do I need to report my state tax refund?

State tax refunds are only taxable if you itemized your deductions the previous year and received a tax benefit from the deduction.

How can I access my 1099-G form online?

Many agencies provide online access to the 1099-G form. Check the website of the Colorado Department of Labor and Employment for more information.

What should I do if there’s a mistake on my 1099-G form?

If you find an error, contact the issuing agency immediately to request a corrected form and keep documentation of the error and correspondence.

Can I file my taxes without the 1099-G form?

While it’s possible, it’s not recommended. The 1099-G form contains important information for accurate tax reporting. Obtain a copy as soon as possible if you haven’t received it.

Conclusion

Understanding the intricacies of the 1099-G Colorado form is crucial for accurate tax filing and compliance. By familiarizing yourself with the form’s details, sections, and implications on your taxes, you can efficiently manage your tax obligations. Avoid common mistakes, ensure all information is correctly reported, and seek professional advice if needed. With this comprehensive guide, you are now equipped to handle your 1099-G form with confidence, paving the way for a smooth and successful tax season.