Filing taxes can be a daunting task, especially when unfamiliar tax forms enter the equation. One such form that can cause confusion for taxpayers in Colorado is the 1099-G. Whether you're receiving unemployment benefits, a state tax refund, or other government payments, understanding the Colorado 1099-G is crucial for accurate tax filing. This article will delve into the specifics of the Colorado 1099-G, its purpose, and how it impacts your tax situation.

Each year, the Colorado Department of Revenue issues the 1099-G form to taxpayers who have received certain types of government payments. These payments can include unemployment compensation, state or local income tax refunds, and other government funds. The form serves as a record of these payments and must be reported on your federal tax return. Failure to do so can result in penalties or additional taxes owed.

In this comprehensive guide, we will break down the components of the Colorado 1099-G, explain how to report it on your tax return, and address common questions and concerns. By the end of this article, you'll be equipped with the knowledge needed to confidently handle your 1099-G form, ensuring a smoother tax season.

Read also:Can Kissing Burn Calories The Unexpected Health Benefits

Table of Contents

- What is the Colorado 1099-G?

- Who Receives the Colorado 1099-G?

- Why is the Colorado 1099-G Important?

- How to Read Your Colorado 1099-G?

- Reporting Colorado 1099-G on Your Tax Return

- Common Mistakes to Avoid with Colorado 1099-G

- What to Do If You Haven't Received Your Colorado 1099-G?

- How to Correct Errors on Your Colorado 1099-G?

- Impact of Colorado 1099-G on Unemployment Benefits

- Does Colorado 1099-G Affect Your Eligibility for Other Benefits?

- What to Do If Your Colorado 1099-G Is Incorrect?

- How Long Should You Keep Your Colorado 1099-G?

- Frequently Asked Questions

- Conclusion

- External Resources

What is the Colorado 1099-G?

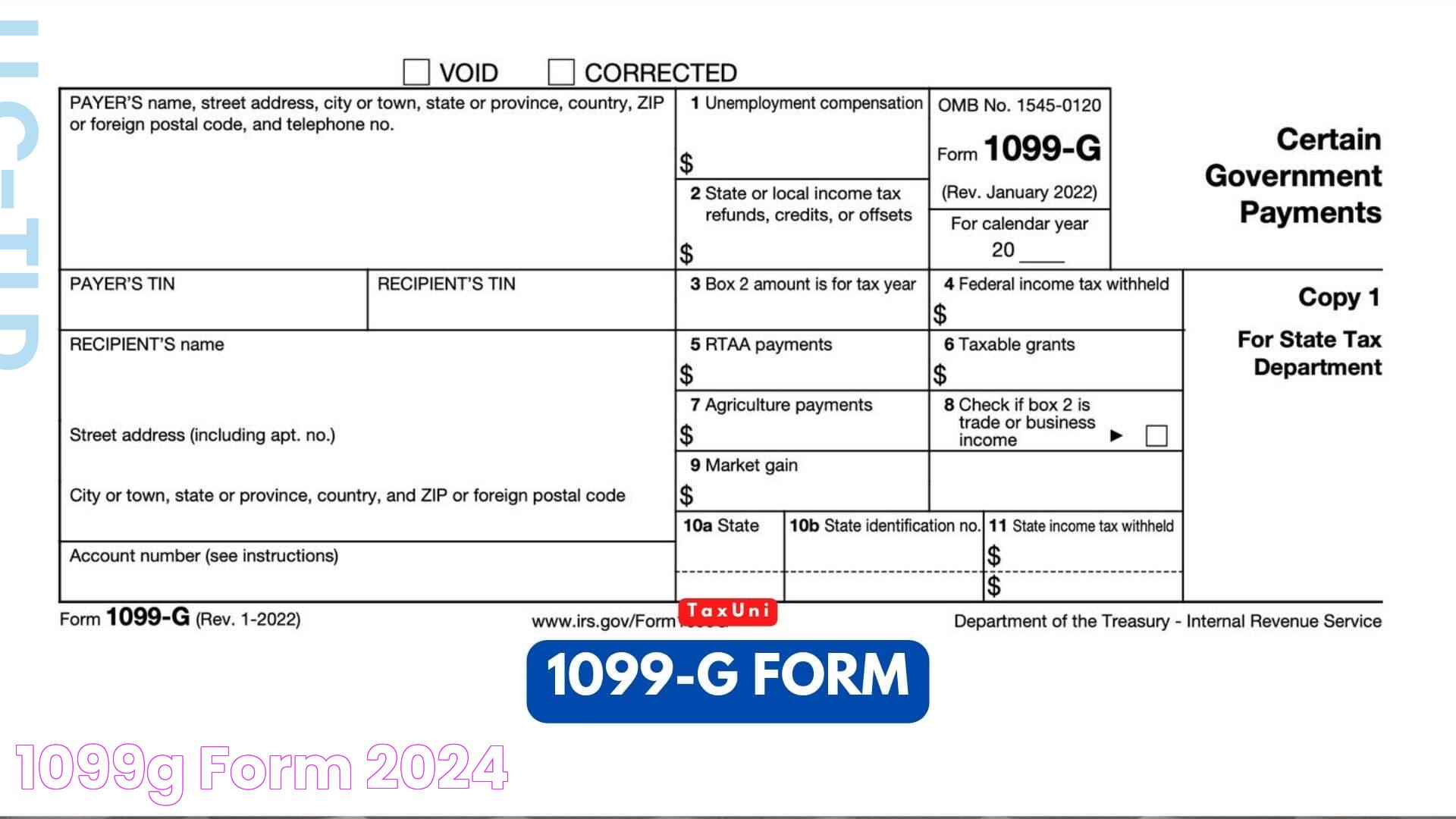

The Colorado 1099-G is a tax form issued by the Colorado Department of Revenue to individuals who have received certain types of government payments during the tax year. The "G" in 1099-G stands for "government." This form primarily reports payments made by the government, including unemployment compensation, state or local income tax refunds, agricultural payments, and other types of government assistance.

The purpose of the Colorado 1099-G is to provide the Internal Revenue Service (IRS) and taxpayers with a record of these payments. The information reported on this form is critical for accurately filing your federal tax return. It ensures that all sources of income, including government payments, are accounted for in your tax filings.

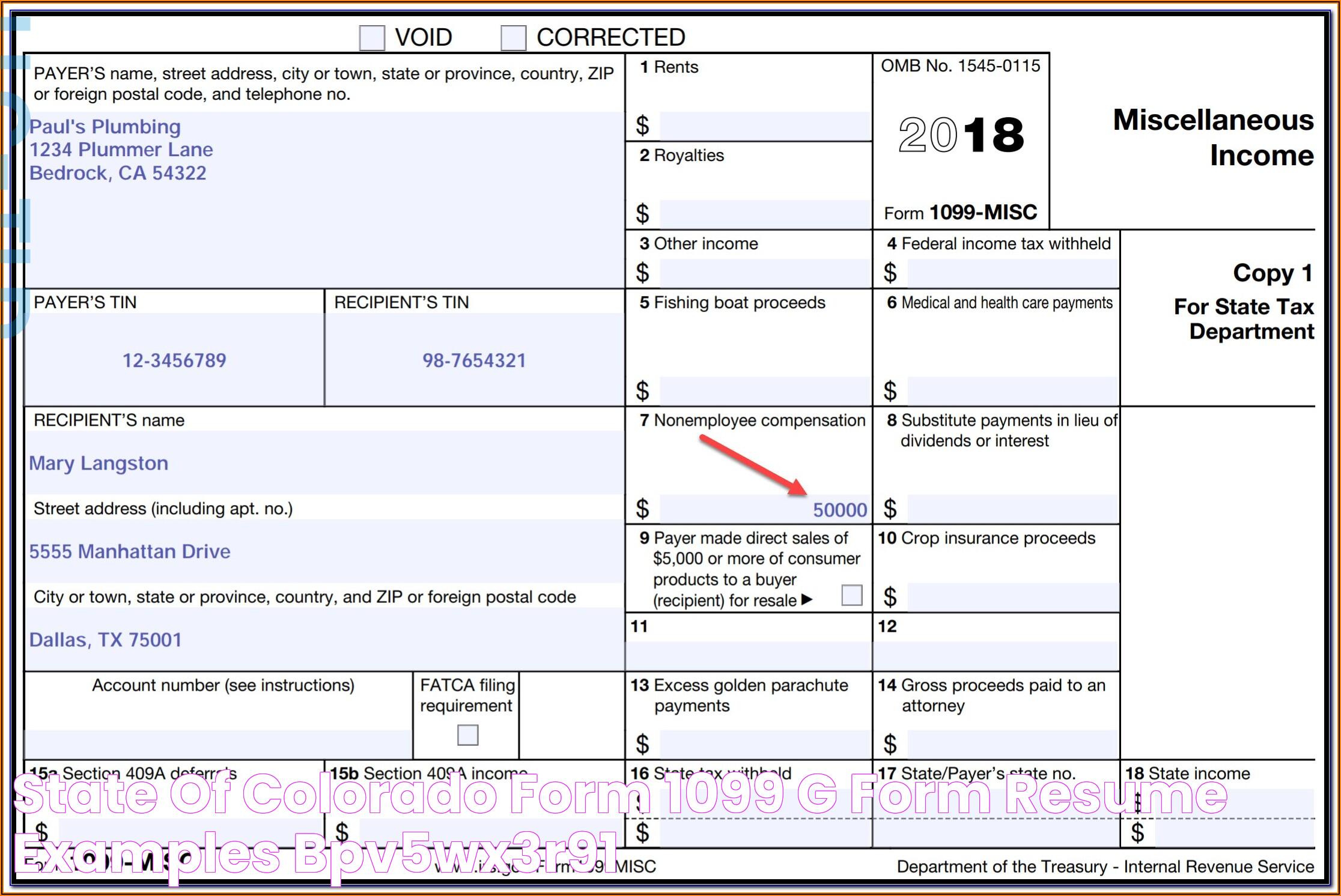

The 1099-G form contains several boxes that detail specific information about the payments you received. Understanding what each box means and how it applies to your situation is essential for accurate tax reporting.

Components of the Colorado 1099-G

- Box 1: Reports the total unemployment compensation received.

- Box 2: Details state or local income tax refunds, credits, or offsets.

- Box 3: Contains any additional payments received that do not fit into other categories.

- Box 4: Reports federal income tax withheld from payments.

- Box 10: State identification number specific to Colorado.

- Box 11: State income tax withheld, if applicable.

Who Receives the Colorado 1099-G?

Not everyone will receive a Colorado 1099-G. This form is issued to individuals who have received specific types of payments from the government. The most common recipients of the Colorado 1099-G include:

- Individuals who received unemployment compensation during the tax year.

- Taxpayers who were issued a state or local income tax refund, credit, or offset.

- Individuals who received agricultural or other government payments.

- Taxpayers who received payments from the Colorado Department of Revenue.

If you fall into any of these categories, you can expect to receive a Colorado 1099-G in the mail, typically by the end of January. It's important to keep this form safe and accessible, as you will need it when filing your federal income tax return.

Do All Refund Recipients Get a Colorado 1099-G?

Not all taxpayers who receive a state tax refund will receive a 1099-G. The issuance of the form depends on whether you itemized deductions in the previous year. If you claimed the standard deduction, you generally won't receive a 1099-G for a state tax refund, as it doesn't need to be reported as income.

Read also:Ibomma New In 2025 The Future Of Digital Entertainment

Why is the Colorado 1099-G Important?

The Colorado 1099-G is important for several reasons:

Compliance with Tax Laws

First and foremost, the 1099-G ensures compliance with federal tax laws. It provides a record of government payments that must be reported as income on your tax return. Failing to report these payments can lead to underreporting of income, which may result in penalties, interest, or an audit by the IRS.

Accurate Tax Reporting

Accurate tax reporting is essential for determining your tax liability. The information on the 1099-G helps you calculate your total taxable income, which in turn affects your tax bracket and the amount of taxes you owe. By including the 1099-G in your tax filings, you ensure that your return is complete and accurate.

Potential Tax Deductions

For taxpayers who itemize deductions, the information on the 1099-G can impact your deductions. For example, if you received a state tax refund, it may need to be included as income on your federal return, depending on whether you itemized deductions in the previous year.

How to Read Your Colorado 1099-G?

Understanding how to read your Colorado 1099-G is crucial for accurate tax reporting. The form contains several boxes, each providing specific information about the payments you received. Let's break down the key components of the form:

Box 1: Unemployment Compensation

Box 1 reports the total amount of unemployment compensation you received during the tax year. This amount must be reported as income on your federal tax return. Unemployment benefits are generally considered taxable income.

Box 2: State or Local Income Tax Refunds

If you received a state or local income tax refund, credit, or offset, this amount will be reported in Box 2. Remember, if you took the standard deduction on your federal return last year, you won't need to report this refund as income.

Box 3: Additional Payments

Box 3 includes any additional payments that don't fall into other categories. This could include agricultural payments or other government assistance you received.

Box 4: Federal Income Tax Withheld

Box 4 reports the amount of federal income tax that was withheld from your payments. This information is important for calculating your total tax liability and potential refund.

Box 10: State Identification Number

Box 10 provides a state identification number specific to Colorado. This number is used for state tax reporting purposes.

Box 11: State Income Tax Withheld

Box 11 reports the amount of state income tax that was withheld from your payments. Like Box 4, this information is crucial for accurately calculating your state tax liability.

Reporting Colorado 1099-G on Your Tax Return

Reporting the information from your Colorado 1099-G on your tax return is a critical step in the tax filing process. Here's how to do it correctly:

Unemployment Compensation

If Box 1 of your 1099-G reports unemployment compensation, you must include this amount as income on your federal tax return. Use Form 1040, and report the amount on the line designated for unemployment compensation.

State or Local Income Tax Refunds

For amounts reported in Box 2, determine whether you need to include this as income. If you itemized deductions last year, the refund might be taxable. If you took the standard deduction, it generally isn't.

Use the IRS worksheet provided in the Form 1040 instructions to determine the taxable amount of your state refund. Report any taxable portion on the line for other income.

Additional Payments

Any additional payments reported in Box 3 should be included in your total income, depending on the type of payment. Follow IRS guidelines for reporting specific types of government assistance.

Federal and State Tax Withheld

Include the amounts from Boxes 4 and 11 on your tax return as taxes paid. This will be applied against your total tax liability, reducing the amount of taxes you owe or increasing your refund.

Common Mistakes to Avoid with Colorado 1099-G

Avoiding common mistakes when handling your Colorado 1099-G can save you time, money, and stress. Here are some pitfalls to watch out for:

Failing to Report Income

One of the most common mistakes is failing to report all income listed on the 1099-G. This can lead to discrepancies in your tax return and potential penalties from the IRS. Ensure you include all relevant amounts as income.

Incorrectly Calculating Taxable Amounts

Miscalculating the taxable portions of your state tax refund or other payments can result in errors on your tax return. Use IRS worksheets and instructions to accurately determine what portions are taxable.

Overlooking Withheld Taxes

Don't overlook the taxes withheld as reported in Boxes 4 and 11. Include these amounts on your tax return to ensure you receive credit for taxes already paid.

Neglecting to Correct Errors

If you notice errors on your 1099-G, don't ignore them. Contact the Colorado Department of Revenue to have them corrected. Incorrect information can lead to discrepancies on your tax return.

What to Do If You Haven't Received Your Colorado 1099-G?

If you're expecting a Colorado 1099-G but haven't received it by early February, take the following steps:

- Check Your Mail: Ensure that the form hasn't been misplaced or mixed in with other mail.

- Verify Your Address: Confirm that the Colorado Department of Revenue has your correct mailing address on file.

- Contact the Department: If you still haven't received your form, contact the Colorado Department of Revenue to request a duplicate copy.

- Access Online: Some taxpayers may be able to access their 1099-G online through the department's website.

Having access to your 1099-G is crucial for timely and accurate tax filing. Don't delay in reaching out if you haven't received your form.

How to Correct Errors on Your Colorado 1099-G?

If you find errors on your Colorado 1099-G, it's important to address them promptly. Follow these steps to correct any inaccuracies:

Contact the Issuer

Reach out to the Colorado Department of Revenue to report the error. Provide specific details about the discrepancy and any supporting documentation you have.

Request a Corrected Form

Request a corrected 1099-G form be sent to you. This will provide the accurate information needed for your tax filings.

Amend Your Tax Return

If you've already filed your tax return using incorrect information, you may need to file an amended return. Use Form 1040-X to make corrections and include the accurate information from the corrected 1099-G.

Addressing errors promptly will help prevent potential issues with your tax return and ensure compliance with tax laws.

Impact of Colorado 1099-G on Unemployment Benefits

The Colorado 1099-G plays a significant role in reporting unemployment benefits. Understanding how these benefits are taxed is essential for accurate tax reporting:

Taxable Income

Unemployment benefits reported on your 1099-G are considered taxable income by the IRS. This means you must include these benefits as part of your total income when filing your federal tax return.

Withholding Options

When you receive unemployment benefits, you have the option to have federal taxes withheld from your payments. If you chose this option, the withheld amount will be reported on your 1099-G and can be credited against your tax liability.

Impact on Tax Bracket

Including unemployment benefits as income can affect your tax bracket and total tax liability. It's important to calculate how these benefits impact your overall tax situation.

Does Colorado 1099-G Affect Your Eligibility for Other Benefits?

Receiving a Colorado 1099-G and the payments it reports can potentially affect your eligibility for other benefits. Here's what to consider:

Income-Based Benefits

Many government assistance programs have income limits. If the payments reported on your 1099-G increase your total income, it could impact your eligibility for income-based benefits such as Medicaid or food assistance.

Program-Specific Rules

Each assistance program has its own set of rules regarding income and eligibility. It's important to understand how the payments on your 1099-G may affect your participation in these programs.

If you're concerned about how your 1099-G may impact your eligibility for other benefits, consider consulting with a tax professional or benefits advisor for guidance.

What to Do If Your Colorado 1099-G Is Incorrect?

If you discover that your Colorado 1099-G contains incorrect information, it's crucial to address the issue as soon as possible. Follow these steps to resolve the problem:

Verify the Information

Double-check the information on your 1099-G against your records to confirm the error. Ensure you have supporting documentation, such as payment records or correspondence from the Colorado Department of Revenue.

Contact the Issuer

Reach out to the Colorado Department of Revenue to report the error. Provide specific details about the discrepancy and any supporting documentation you have.

Request a Corrected Form

Request a corrected 1099-G form be sent to you. This will provide the accurate information needed for your tax filings.

Amend Your Tax Return

If you've already filed your tax return using incorrect information, you may need to file an amended return. Use Form 1040-X to make corrections and include the accurate information from the corrected 1099-G.

Taking prompt action to correct errors will help ensure your tax return is accurate and compliant with federal tax laws.

How Long Should You Keep Your Colorado 1099-G?

Keeping your Colorado 1099-G and other tax documents is an important aspect of tax record-keeping. Here's how long you should retain these documents:

General Rule

As a general rule, the IRS recommends keeping tax records for at least three years from the date you filed your original return. This period covers the time frame during which the IRS may initiate an audit or review your return.

Extended Record Retention

In some situations, you may need to keep records for a longer period. For example, if you file a claim for a refund or credit, keep your records for three years from the date you filed your original return or two years from the date you paid the tax, whichever is later.

Special Circumstances

Certain circumstances, such as underreporting income or filing a fraudulent return, may require you to keep records indefinitely. Consult the IRS guidelines for specific record-keeping requirements based on your situation.

Properly organizing and storing your tax records, including your Colorado 1099-G, will help ensure you have the necessary documentation if questions arise about your tax return.

Frequently Asked Questions

What should I do if I lose my Colorado 1099-G?

If you lose your 1099-G, contact the Colorado Department of Revenue to request a duplicate copy. Having the form is essential for accurate tax filing.

Is the Colorado 1099-G form available online?

Some taxpayers may be able to access their 1099-G form online through the Colorado Department of Revenue's website. Check the website for more information on accessing your form electronically.

Do I need to report a state tax refund if I took the standard deduction?

If you took the standard deduction on your federal tax return, you generally do not need to report a state tax refund as income. However, if you itemized deductions, you may need to include it.

Can I dispute the amount reported on my Colorado 1099-G?

If you believe the amount reported on your 1099-G is incorrect, contact the Colorado Department of Revenue to dispute the amount and request a corrected form.

How does receiving a Colorado 1099-G affect my state taxes?

The 1099-G primarily affects your federal taxes, but the payments reported on it may also need to be included in your state tax return, depending on your state's tax laws.

What if I received a 1099-G for a payment I didn't expect?

If you receive a 1099-G for a payment you didn't expect, verify the accuracy of the form with the Colorado Department of Revenue. It may indicate a clerical error or an unanticipated payment.

Conclusion

Handling your Colorado 1099-G form correctly is essential for accurate and compliant tax filing. By understanding the components of the form, reporting the information accurately, and addressing any errors promptly, you can avoid common pitfalls and ensure your tax return is complete. Remember to keep your tax documents organized and retain them for the appropriate period, as recommended by the IRS. With this guide, you're now equipped to navigate the complexities of the Colorado 1099-G and approach tax season with confidence.

External Resources

For more information on handling your Colorado 1099-G and other tax-related inquiries, visit the official IRS website. The site offers comprehensive resources and guidance on tax laws, forms, and filing requirements.