There could be multiple reasons for wanting to cancel your Progressive Insurance policy. Perhaps you've found a better deal elsewhere, or maybe your circumstances have changed, and you no longer need the coverage. Whatever your reason may be, it's essential to understand the process to ensure a smooth transition. In this comprehensive guide, we'll explore the steps you need to take, along with any potential pitfalls and considerations you should be aware of when canceling your policy with Progressive.

Before you make any decisions, it's crucial to weigh the pros and cons of canceling your current insurance policy. Keep in mind that canceling your insurance might lead to certain repercussions, such as coverage gaps and potential penalties. That said, if you've decided to move forward, knowing the precise steps and having all the necessary information at hand will make the process much smoother. Let's delve into the specifics of how you can go about canceling your Progressive Insurance policy effectively and efficiently.

Table of Contents

- Understanding Progressive Insurance

- Reasons to Cancel Progressive Insurance

- Preparing to Cancel Your Policy

- How Can I Cancel Progressive Insurance?

- What Documents Are Needed?

- How to Avoid Coverage Gaps?

- Notifying Progressive

- Understanding Pro-Rated Refunds

- What Are the Alternatives?

- Impact of Cancellation on Credit Score

- How to Switch to a New Insurer?

- Common Mistakes to Avoid

- Frequently Asked Questions

- Conclusion

Understanding Progressive Insurance

Progressive Insurance, founded in 1937, has grown to become one of the largest insurance providers in the United States. Known for its innovative approaches, such as the introduction of the first drive-in claims office and a competitive price structure, Progressive has a strong reputation for customer service and comprehensive coverage options.

Read also:How To Change Name In Tinder A Stepbystep Guide

The company offers a wide range of insurance products, including:

- Auto Insurance

- Homeowners Insurance

- Renters Insurance

- Motorcycle Insurance

- RV Insurance

- Life Insurance

- Pet Insurance

Progressive is particularly known for its Snapshot program, which personalizes insurance rates based on an individual's driving habits. This usage-based insurance program rewards safe drivers with discounts, encouraging responsible driving behavior.

Company Overview and Offerings

Progressive's business model focuses on providing cost-effective solutions while maintaining a high standard of customer service. They offer both direct-to-consumer sales and partnership policies with independent agents, allowing flexibility and choice for their customers. Their competitive pricing and robust online platform make it easy for policyholders to manage their accounts, file claims, and access support.

Key Features of Progressive Insurance

- Flexible Policy Options: Customize coverage to fit your needs.

- 24/7 Customer Support: Access help whenever you need it.

- Discount Opportunities: Save with multiple policy discounts and safe driver rewards.

- Comprehensive Online Tools: Manage your policy easily through their app or website.

Reasons to Cancel Progressive Insurance

There are several reasons why someone might choose to cancel their Progressive Insurance policy. Understanding these reasons can help you make an informed decision and prepare adequately for the cancellation process.

Cost Considerations

One of the most common reasons for canceling an insurance policy is cost. As life circumstances change, so do financial priorities. If you've found a more affordable insurance provider that offers comparable coverage, it might be worth considering a switch. However, it's important to weigh the potential savings against any penalties or fees that may apply when canceling your Progressive Insurance policy.

Change in Coverage Needs

Life events such as buying a new car, moving to a new home, or changing your marital status can significantly impact your insurance needs. If Progressive no longer offers the best coverage for your current situation, it might be time to explore other options that better align with your needs.

Read also:Guide To Pitbull Male Weight Understanding Your Bullys Size

Dissatisfaction with Service

Another common reason for cancellation is dissatisfaction with the service provided by Progressive. This could include issues with claims processing, customer service experiences, or difficulty accessing policy information. If you've repeatedly encountered these issues without resolution, seeking an insurer with a better track record for customer satisfaction might be beneficial.

Preparing to Cancel Your Policy

Before you proceed with canceling your Progressive Insurance policy, it's crucial to prepare adequately to ensure a smooth transition. Proper preparation can prevent potential issues, such as coverage gaps or unexpected fees.

Review Your Current Policy

Start by thoroughly reviewing your current policy documents. Pay special attention to the following:

- Cancellation Policy: Understand any penalties or fees associated with early cancellation.

- Coverage Details: Ensure you know what coverage you currently have and what you may need moving forward.

- Renewal Dates: Be aware of your policy renewal dates to avoid automatic renewals.

Research Alternative Insurance Options

Once you've assessed your current policy, begin researching alternative insurance options. Consider the following factors when evaluating new providers:

- Cost: Compare premiums and potential discounts.

- Coverage: Ensure the new policy meets your needs.

- Reputation: Look for customer reviews and ratings of the new provider.

- Customer Service: Evaluate the level of support offered by the insurer.

How Can I Cancel Progressive Insurance?

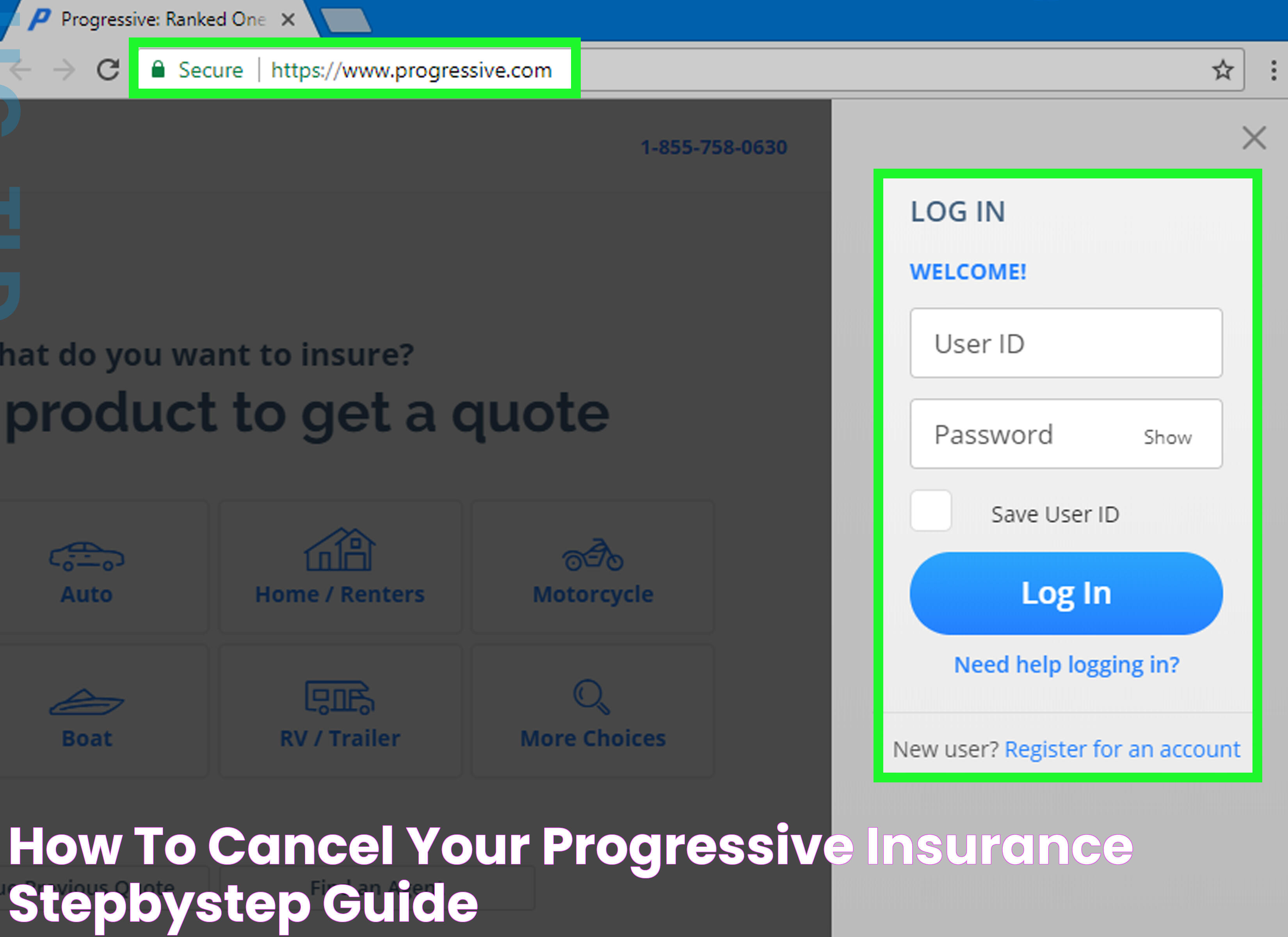

Once you've decided to cancel your Progressive Insurance policy, follow these steps to ensure a smooth cancellation process:

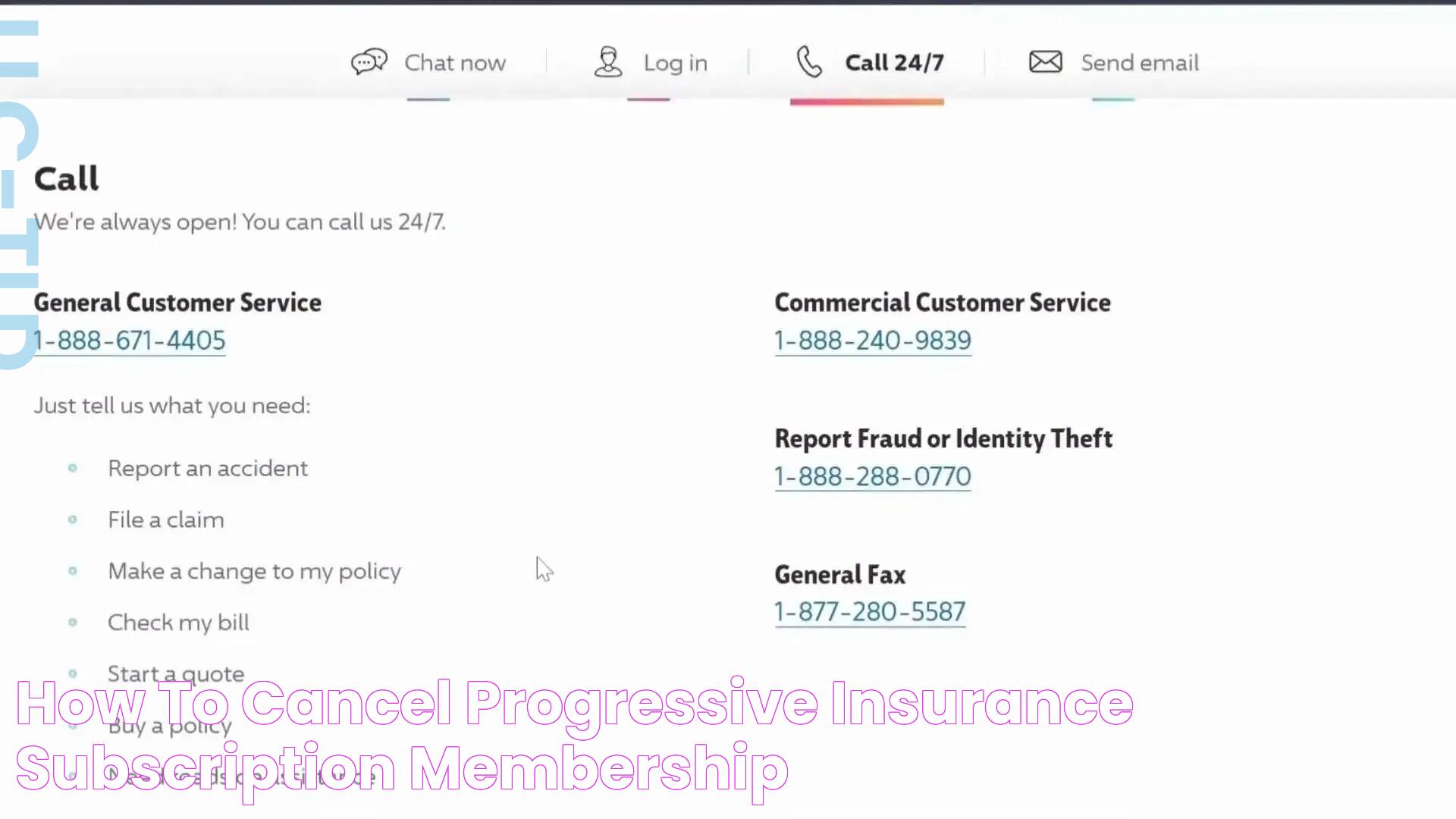

Contact Progressive

The first step is to contact Progressive directly. You can reach them through various channels:

- Phone: Call their customer service hotline.

- Online: Use their website or mobile app to initiate the cancellation.

- In-Person: Visit a local branch if you prefer face-to-face interaction.

Provide Necessary Information

When contacting Progressive, be prepared to provide the following information:

- Your policy number

- Personal identification details

- The reason for cancellation

- The effective date of cancellation

Confirm Cancellation Details

After initiating the cancellation, request confirmation of the cancellation details in writing. This should include:

- Cancellation effective date

- Any applicable fees or refunds

- Confirmation number or reference for the cancellation

Verify Refunds and Final Bills

If you're eligible for a refund or have outstanding balances, ensure these are addressed promptly. Verify with Progressive regarding any final bills or refunds due to you.

What Documents Are Needed?

When canceling your Progressive Insurance policy, having the necessary documents ready can streamline the process. Here are the key documents you might need:

Policy Documents

Keep your policy documents on hand, as they contain crucial information such as your policy number, coverage details, and cancellation terms.

Identification

Be prepared to provide personal identification details, such as your driver's license or other government-issued ID, to verify your identity.

New Insurance Policy Details

If you're switching to a new insurance provider, have your new policy details ready. This includes the policy number, coverage start date, and insurer contact information.

How to Avoid Coverage Gaps?

Avoiding coverage gaps is crucial when canceling your Progressive Insurance policy. Coverage gaps can leave you vulnerable to financial risks and potential legal issues.

Plan the Transition

Ensure that your new insurance policy begins before or on the same day your Progressive policy ends. This prevents any period where you're uninsured.

Communicate with Both Insurers

Maintain open communication with both Progressive and your new insurer. Confirm the cancellation date with Progressive and the start date with your new provider to align the transition effectively.

Monitor the Transition

Keep an eye on the transition process to ensure there are no hitches. Verify that your new policy is active and your Progressive policy is successfully canceled.

Notifying Progressive

Notifying Progressive of your intent to cancel is a critical step in the process. Proper notification ensures that your request is processed accurately and promptly.

Direct Contact

Reach out to Progressive using their official contact channels. This includes their customer service hotline, online portal, or visiting a local branch.

Written Confirmation

Request written confirmation of your cancellation request. This serves as proof of your intent and can be useful if any disputes arise later.

Understanding Pro-Rated Refunds

When you cancel your Progressive Insurance policy, you may be entitled to a pro-rated refund. Understanding how this works is essential for managing your finances post-cancellation.

What Is a Pro-Rated Refund?

A pro-rated refund is a partial refund of your premium based on the remaining coverage period. If you've paid your premium in advance, you may receive a refund for the unused portion of your coverage.

Calculating Your Refund

Your refund amount will depend on several factors, including:

- The original premium amount

- The number of days remaining in your coverage period

- Any applicable cancellation fees

What Are the Alternatives?

If you're considering canceling your Progressive Insurance policy, it's worth exploring alternatives that might better suit your needs.

Adjusting Your Current Policy

Before canceling, consider adjusting your current policy. This might involve changing coverage limits, adding or removing specific coverage options, or exploring discounts.

Shopping for New Coverage

Research and compare quotes from other insurance providers. Look for similar coverage options at competitive rates to ensure you're making an informed decision.

Impact of Cancellation on Credit Score

Canceling your Progressive Insurance policy could have implications for your credit score, primarily if it's linked to your payment history and financial behavior.

Factors Influencing Credit Score

Insurance cancellations typically don't directly impact your credit score. However, if your insurance payments are tied to a credit account, any missed payments or delinquencies could affect your credit rating.

Maintaining a Positive Credit Score

- Ensure all outstanding balances with Progressive are settled promptly.

- Monitor your credit report regularly to identify any discrepancies or inaccuracies.

- Maintain a positive payment history with your new insurer to support a healthy credit score.

How to Switch to a New Insurer?

Switching to a new insurer requires careful planning to ensure a seamless transition without coverage gaps or complications.

Research and Compare Quotes

Begin by researching and comparing quotes from various insurance providers. Consider factors such as coverage options, pricing, and customer reviews to identify the best fit for your needs.

Secure New Coverage

Once you've selected a new insurer, secure your new policy. Confirm the coverage start date to align with the cancellation date of your Progressive policy.

Inform Your Current Insurer

Notify Progressive of your intent to cancel and provide the effective date of cancellation. Confirm the cancellation details in writing to prevent any misunderstandings.

Common Mistakes to Avoid

Canceling your Progressive Insurance policy can be straightforward if you avoid common mistakes that could complicate the process.

Overlooking Policy Details

Thoroughly review your current policy to understand any cancellation fees, coverage limits, and renewal dates that might impact your decision.

Failing to Secure New Coverage

Ensure you have a new insurance policy in place before canceling your Progressive coverage to avoid any gaps that could leave you exposed.

Frequently Asked Questions

1. Can I cancel my Progressive Insurance policy online?

Yes, you can initiate the cancellation process online using Progressive's website or mobile app. However, you may need to follow up with a phone call or in-person visit to finalize the cancellation.

2. Are there any cancellation fees with Progressive Insurance?

Progressive may charge a cancellation fee depending on your policy terms. It's essential to review your policy documents or contact Progressive directly to understand any applicable fees.

3. How long does it take to process a cancellation with Progressive?

The cancellation process can vary, but it typically takes a few days to a week to process. Request written confirmation of your cancellation to ensure it's been finalized.

4. Will canceling my policy affect my driving record?

Canceling your insurance policy does not directly impact your driving record. However, having continuous coverage is essential for maintaining a good insurance history.

5. Can I reinstate my Progressive policy after cancellation?

Reinstating a canceled policy is possible but may require a new application process. Contact Progressive for details on their reinstatement policy.

6. What should I do if I have a claim during the cancellation process?

If you need to file a claim during the cancellation process, contact Progressive immediately to report the incident and begin the claims process.

Conclusion

Canceling your Progressive Insurance policy requires careful consideration and planning to ensure a smooth transition. By understanding the reasons for cancellation, preparing adequately, and following the necessary steps, you can effectively manage the process without encountering significant issues. Remember to secure alternative coverage to avoid any gaps and maintain continuous protection. With the right approach, you can successfully navigate the cancellation process and find an insurance solution that better suits your needs.